Date: 30 April, 2020 - Blog

1Q 2020 US results will be broadly below expectations compared to early April estimates due to large provisions in banks and falling profits for airlines and oil companies. 2T 2020, published in early July, will be terrible. But the stock market will cope if deconfinements are going well, investors anticipating a recovery in V in 2021.

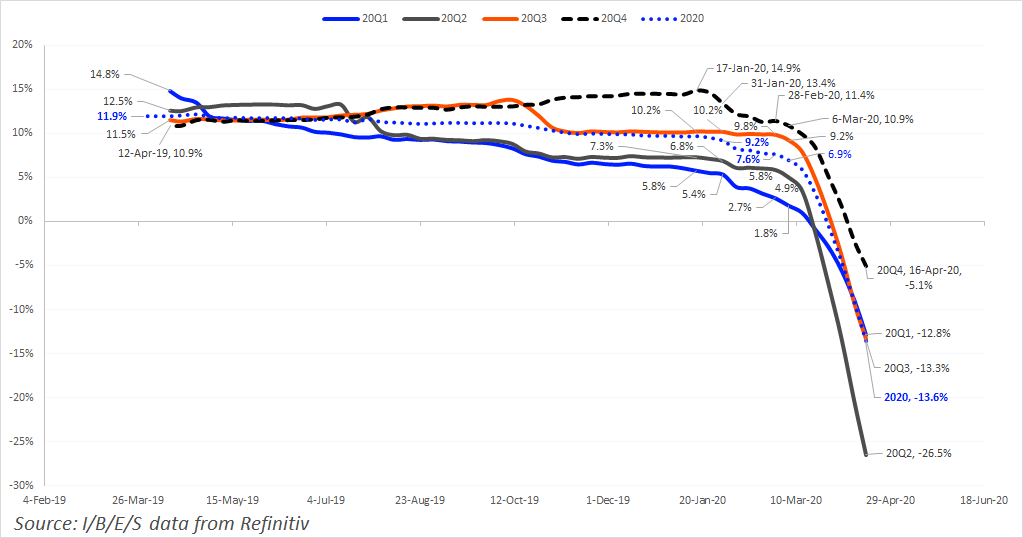

25% of S&P 500 companies published for 1Q 2020: +1.8% for revenues and -17.6% for profits. Facset estimates a 15.8% drop in profits and Lipper Alpha -14.8%. 1Q 2020 was affected by confinement in China in February and March, and by confinement in the last two weeks of March in Europe. For the 2Q 2020, the decline in profits is expected between -30% and -40%, impacted by the confinement in Europe in April and in May in Europe and the United States. The second semester is expected with a slower recovery due to the very gradual national deconfinements until September. For 2020, profits are expected to fall by 15% / 20% with a bottom-up approach and 25% / 30% with a top down approach; a vigorous recovery is expected in 2021 with +25%.

S&P 500. Quarterly profit evolution in 2020

Mention should be made of the May WTI futures crash that occurred on Monday and Tuesday, which saw the price per barrel of WTI drop to – $40. It was a financial and technical crash. The impact will be very limited. The vast majority of professional traders and funds had seen the problem with the volume of contracts well before and had already rolled their positions to longer maturities. It was the retail / individual investors who took the hit: for the past few weeks, they have been massively buying the ETF USO, the United States Oil Fund LP which invests in oil futures contracts, to participate in the oil trade.

For the past 2 weeks, the Chicago Mercantile Exchange (CME), the US regulator and professionals have been expecting negative prices and have prepared for the shock. The CME was prepared to let WTI prices go into negative territory; its CEO said after the shock: “It was no secret that we were going to pass negative prices. The CME is responsible to professionals, not to novice investors”. Professionals are attentive to the June deadline, but we do not think that the same situation will arise: traders roll their contracts on maturities beyond June, the supply will be reduced (in the United States, 40% of the drilling rigs closed in 1 month) and demand will start to resume in early June.

The week will be important with meetings of the Fed and the ECB, as well as the publication of the results of 25% of the S&P 500, including Alphabet, Boeing, Microsoft, Facebook, Tesla, Mastercard, Amazon, Apple, McDonald’s, ConocoPhillips, Exxon Mobil, Chevron, Honeywell. In Europe, BP and Royal Dutch Shell will also publish.

- Despite a terrible year for profits, we do not believe that the stock market indices will return to March lows due to the extraordinary support of central banks and governments

- No major impact linked to the oil futures crash that occurred on Monday and Tuesday. The Chicago Mercantile Exchange and professionals were prepared for it