Date: 6 February, 2020 - Blog

Since mid-January, indices have been in consolidation mode

The trigger was the coronavirus and its impact on the Chinese and global economy, also affecting cyclical commodities prices such as copper and oil. The good news is that the momentum on stock market is easing significantly.

As a reminder, the definition of a consolidation is a period of stabilization (lateral trading range) after a strong increase, with a limited falling prices potential (estimated c. 2%-4%), that of a correction is at least a 10% decline and that of a bear market a drop larger than 20%. Since their mid-January 2020 highs, the MSCI World has fallen by 3%, the S&P 500 by 3.1% and the Stoxx 600 by 3.3%. We are therefore still in a consolidation phase.

However, in the case of a significant economic impact from the coronavirus, the indices could enter into a corrective phase with a 6%-9% drop from their mid-January peaks.

The MSCI World closed on a support last Friday.

The next supports are 2.5% (MACD 100d), 5% (MACD 200d) and 6% (bottom of the corridor) lower.

Source: Heravest, Bloomberg

While the risk of further index pullbacks is real due to a critical disruption in China’s supply chains, analysts are starting to anticipate large-scale Chinese fiscal and monetary measures to support the economy.

The Q4 19 US results and guidance are better than expected, especially from the technology sector, which bodes well for 2020 given the weight of technology in the global indices. Driven by Technology and Consumer Discretionary, Factset significantly revised up the US profits drop to -0.3% from -2% and Lipper Alpha expects them to rise by 1.1% in Q4 19. Excluding energy, US profits are expected to increase by 4%. Analysts are still expecting a 10% profits’ increase in 2020 thanks to this great Q4 19 profit dynamics.

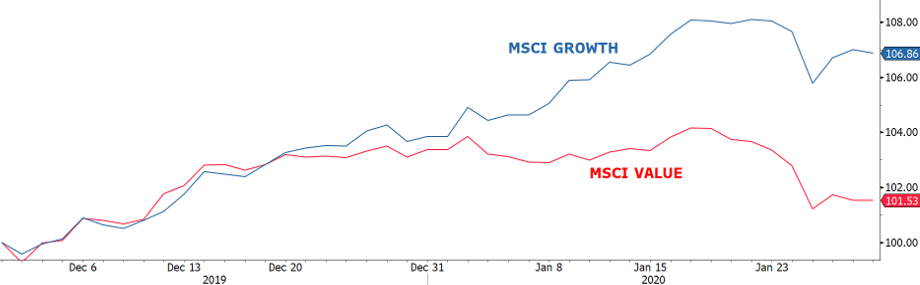

The current risk-off sentiment and the expectations of tighter liquidity injections from the Fed as of April favor the Growth segment, and technology and communication services in the first instance, integrating Amazon, even if it is in the Consumer Discretionary sector.

MSCI Growth and Value performances (base 100)

Source: Heravest, Bloomberg

- Favor the Growth segment in the short-term, which is more defensive with coronavirus shock

- We are in a consolidation phase

- We hope that the coronavirus will decelerate, otherwise we could go to a corrective phase