Date: 15 September, 2022 - Blog

Against a backdrop of persistent and elevated inflation, the European Central Bank delivered as expected the largest hike since the start of the Union by raising key rate by 75bps to 0.75%. It joins the club of central banks that have at least increased rates by 75bps this year.

The ECB also mentioned that inflation remains far too high and that further rates hikes will be needed. It has significantly revised up its inflation forecasts to 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. This is in line with market consensus for 2022 and 2024, but much higher than the market (4.8%) for 2023. The ECB finally acknowledged a growth momentum slowdown. The

Eurozone economy is likely to stagnate in late 2022 and early 2023. More broadly, it lowered its GDP growth projections to 3.1% for 2022, just 0.9% for 2023, and 1.9% for 2024.

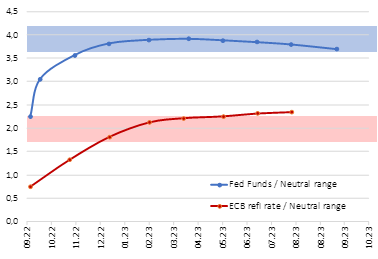

Over the next several meetings, the ECB should raise rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations. Even if the Eurozone economic recession becomes clearer, the ECB will benefit from the growth overhang accumulated in H1 allowing it to raise rates until year-end. It should implement another 75bps in late October, plus another 50bps hike in December, lifting its key rate to 2.00% by year-end.

As the ECB finally acknowledged for, economic momentum is likely to slow sharply in S2. Recent surveys suggest slower growth, and a Eurozone recession remains likely in the months ahead. For August, the Eurozone manufacturing and services PMIs were both below the minimum level to avoid falling into a period of economic contraction. The risk of a Eurozone recession beginning by late this year remains on course, which should also mean that the end of the ECB tightening cycle. So, it should hold rates steady through 2023.

Policy rates are already expected to be in restrictive territory

When it comes to purchasing programs reinvestments, the ECB intends to keep reinvesting proceeds from bonds maturing under the Asset Purchase Program for an extended period, and to keep reinvesting proceeds from the Pandemic Emergency Purchase Program until at least 2024-end.

- Even if the ECB is still far more optimistic about growth (+0.9%) in 2023, the question remains whether it would really be willing to continue hiking as aggressively as implied if the recession becomes reality. Raising rates as a recession approaches is one thing, raising them during a recession is another

- The Italian spread will remain defended by the Bank. There did not appear to be any in depth discussion of quantitative tightening at this meeting. Italian government bonds are attractive