Date: 21 August, 2020 - Blog

The Australian central bank (RBA), for the first time since early May, entered last week the market to purchase AUD1bn of Australian government bonds as part of its Yield Curve Control program. Most of its purchases focused on 3 years bonds. This is confirming the yield target approach. The RBA Governor Lowe made his bi-annual economic update. His dominant theme was the need to support job creation. His position on borrowing and budget deficits is quite clear. Borrowing today to support the economy is essential to avoid an even bigger loss of output and jobs that would damage the economy and society for years. As Australian public finances are healthy (low public debt level), financing costs have never been lower. Expansionary fiscal policy has adequate scope to boost demand. Regarding Federal (314bn) and States supports (44bn), he noted that the states have considerable influence on job creation and should focus on it rather than protecting their credit ratings. The RBA targets are full employment (5.0%) and stable inflation (2–3%). Given its inflation and unemployment rates forecasts at 1.5% and 7% by December 2022, it will stay accommodative for a while.

As expected, the New Zealand central bank (RBNZ) did not cut rates but expanded its asset purchasing program. The RBNZ will now buy up to NZD100bn of assets, up from NZD60bn previously. As New Zealand approaches a period of higher bond issuance to finance its Covid-19 relief measures, the move is logical.

Governor Orr also announced that the bank is actively preparing an additional set of stimulus tools to be used as necessary depending on growth and inflation. This would include negative rates and the possibility of buying foreign assets. Investors and market pricing are still not convinced the RBNZ will ultimately take the road of negative rates and this may explain NZD resilience.

At this stage, it appears that the RBNZ may have to deliver and effectively cut rates to prompt a sizeable NZD downward correction. Still, curbing the currency strength may not be enough of a reason to jump into the risky negative rates territory. An alternative path could be direct FX interventions. This was mentioned in the statement, but the Governor appears to have little appetite for this option. The Swiss National Bank experience shows that it is extremely complicated, risky, and potentially “costly” for small players to fight market trends. The RBNZ dovish tone is not a substantial obstacle to more NZD upside unless the RBNZ effectively decides to adopt negative rates.

Even the resurgence of Covid-19 fears in Auckland will have limited ability to dampen the NZD. Its neighbor, the AUD, did not particularly suffer the strict lockdown imposed in Victoria lately after the massive flare-up in Covid cases. This could be the case for NZD too if another health emergency in the country were to emerge.

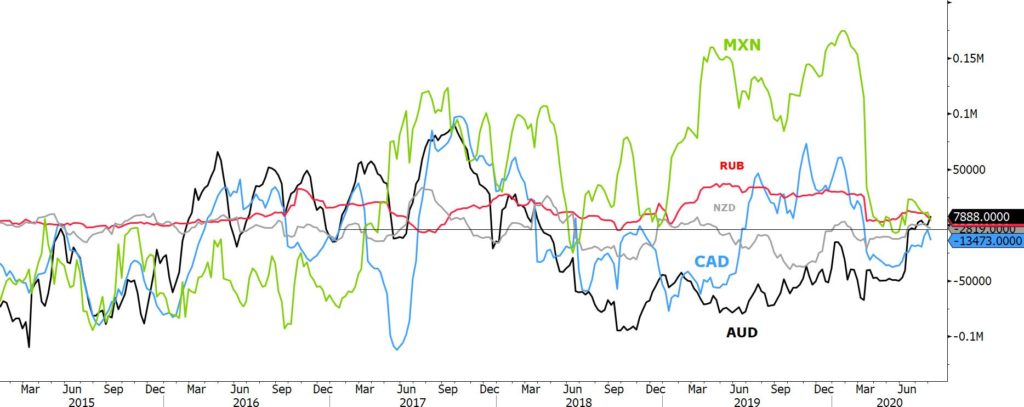

Speculative positioning

Source: Bloomberg

Furthermore, the current light positioning on commodity related currencies, by speculators, highlights once again that investors are focusing on core holdings instead of satellites.

- Risk appetite takes over central banks rhetoric