Date: 24 September, 2020 - Blog

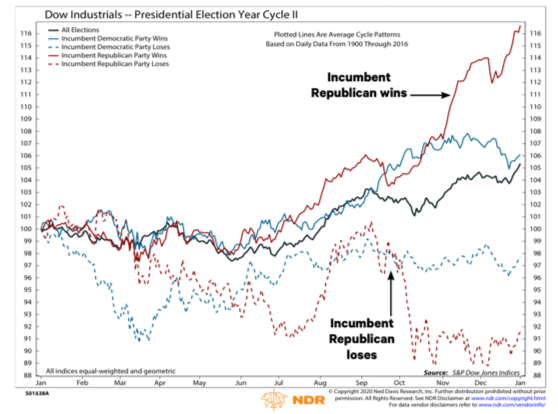

D. Trump is the 12th president since 1900, and sixth since 1950, to run when there is a recession (or bear market) during an election year. If history is any guide, recessions and major market declines do not bode well for incumbent party and President.

Will voters also blame Trump this time?

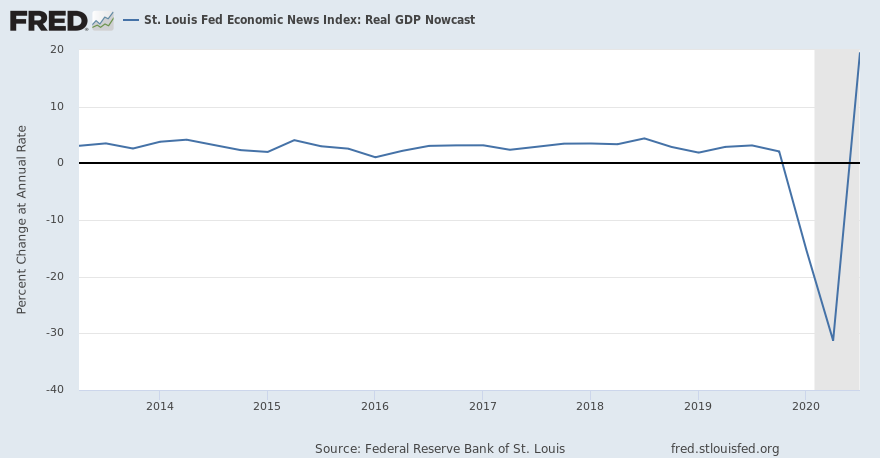

Fortunately, a dramatic recovery started in Q3, but…

According to the latest forecasts, US GDP is going to recover dramatically from the dismal Q2. Still, the magnitude of the rebound is much lower than that from the contraction. More, Q4 will probably experience a very benign – if positive – print.

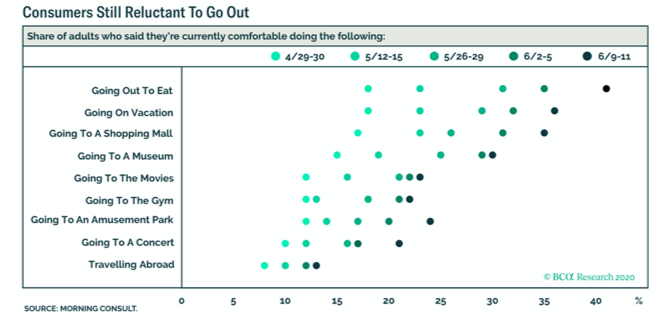

Indeed, the pandemic is far from contained and consumers – the lion share of the US economy – remains severely depressed. Unemployment rate is sky-high at 8.4% and will take a long time before getting back to more normal level. Lots of Firms, which benefitted from the State Aid in Q3, have just started to fire furloughed employees… The social distancing and fear from the virus are deeply impacting consumers’ behavior. Part of this stigma should continue up to the infection is really under control, i.e. not just in the talks of political leaders!

The question of whether the stimulus continues to steady the economy or not through Election will be a key determinant for President Trump to avoid the dire implications of the macro backdrop. Time is running short for him to launch the so-called phase 4 of stimulus, as the former phases of US State Aide have been blocked since end-July. It seems that both Republicans and Democrats are prepared to head into the election without passing another coronavirus bill, with each party betting that the other side will get the blame for inaction. Still, a ̈stop-gap ̈ bill got bipartisan support lately; it should avoid a dramatic – mechanical – government shutdown to occur over next weeks…

The virtuous flexibility of the US labor market is not advantageous under current circumstances, as it will leave millions of US workers by the wayside in 2020 and 2021. The odds of a K-shaped economic recovery, where high earners are faring much better than low-wage worker, are rising. While the financial services sector has already recovered 94% of its pre-pandemic employment, leisure and entertainment industries have only brought back 74% of their former workers. Low-wage jobs like restaurant staff, transportation workers, and cleaners are unlikely to recover soon.

Macro and political volatility will continue to build up before November elections

In the past, elections mattered for markets

If history is any guide, the outcome of Presidential elections should – normally – significantly impact Wall Street. According to latest polls, Democrats are due to win.

But when it comes to other interesting sources, like betting odds, the situation is much less obvious.

- A new significant coronavirus package / stimulus is unlikely before elections

- If coupled with a troubled election process, it could result in a double-dip recession in the US in a dark scenario

- This is not our main scenario. But in the short-term, uncertainty and markets jitters are likely to prevail