Date: 1 November, 2018 - Blog

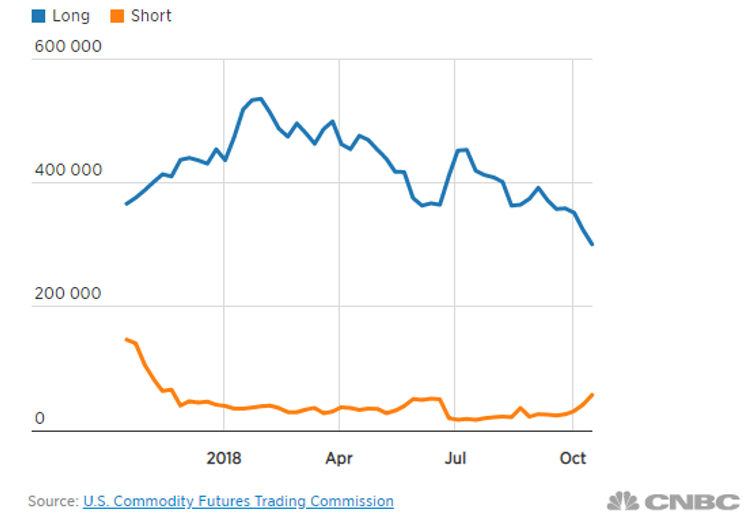

A few weeks ago, investors expected a price of Brent at $ 100 a barrel, due to upcoming US sanctions on Iran’s oil exports. Today, hedge funds are closing their long positions. A price of $ 100 is no longer so certain. Brent lost $ 10 in 3 weeks.

The futures on the WTI price have moved into contango, meaning that it is less attractive for traders to roll their positions on longer maturities; so they think today that there is no longer a supply problem in the medium term. The market is now worried about weaker than expected demand in 2019 and higher Saudi and Russian output. Russia and OPEC collectively increased production despite the decline in Iran and Venezuela.

We still doubt that Brent reaches $ 100 on a fundamental basis and consider that the evolution of the oil price is essentially political. The abominable assassination of Khashoggi was a trigger and confirms this : negotiations between the United States and Saudi Arabia have probably led to the acceptance of “explanations” re: the Saudi assassination against a decline in the price of crude. Saudi Arabia produces 11 million barrels a day, its production cost is excessively low at about $ 5 per barrel, and its capacity to easily increase production is estimated between 1 and 2 million barrels a day. And the two major customers of Saudi Arabia, China and India, would certainly not have accepted a Brent price of $ 100 a barrel.

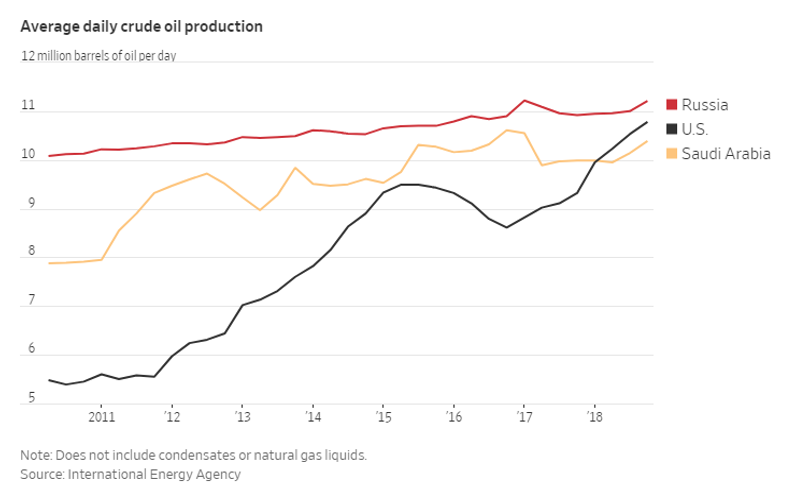

There is no structural problem of supply today. Neither in 2019, because the potential return of Venezuela and Iran would bring some 3 million b / d in the market. On the other hand, by 2020 and later, the supply could become structurally insufficient if demand maintains its cruising speed. Since 2012, demand has increased by 1.5 million barrels/day, filled by the sharp rise in US production. See chart below. But all experts agree that US shale gas growth has reached its limits because of bottlenecks in pipelines and storage, and the sharp rise in marginal cost.

Oil production. The US has overtaken Saudi Arabia and is approaching Russia

The Energy sector has experienced profits taking, but of the same magnitude as those of the market in general. Despite a 16% increase in oil prices in 2018, energy equities show weak performances. Investors are disappointed by the growth in output of oil companies. Since 2016, oil companies have started reinvesting in production and exploration, but in a very controlled manner. In September, Transocean canceled a $2.7bn acquisition with Ocean Rig. Total and Equinor have readjusted downward their investment forecasts. This prudence in investment, which will result in modest growth in production in the coming years, does not please to investors. It should become a positive factor if the price of oil stabilizes or falls. We remain overweight, but we will monitor the evolution of demand.

- A price between $ 70 and $ 80 a barrel of Brent in 2019 seems fair