Date: 9 May, 2022 - Blog

From a supply shock to a demand shock?

Energy and industrial metal prices are rising due to multiple disruptions caused by Covid and the war in Ukraine. The energy transition contributes to this on certain metals. This supply shock results in a very sharp rise in inflation. This supply shock also reflects the lack of investment since 2016 in new production capacities due to environmental and social constraints, as well as the new global geopolitics that favor the nationalization of exploitation and production. The profitability of projects is no longer guaranteed.

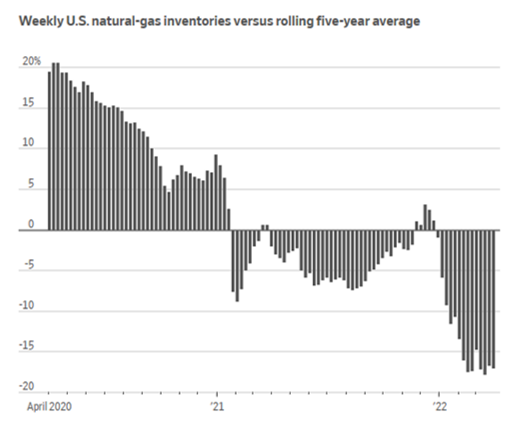

Oil and gas companies posted huge profits, including large write-downs on Russian assets. With inflation, refining margins are rising. Companies announced larger share buyback programs, higher dividends and debt repayments, but very little investment in new projects. Despite record LNG exports and low stocks, worrying professionals for the coming winter, American gas companies want to maintain strict financial discipline and favor shareholders. Other factors are holding back the increase in production: the shortage of labor and capital goods.

Source : Energy Information Administration

Mining groups have also published excellent results. On the other hand, production targets have been difficult to achieve due to disruptions with workers (Covid, social unrest) and transport. Compared to the oil/gas industry, the mining industry is much more sensitive to malfunctions in labor and logistics.

This known supply shock, will it replace by a demand shock that will lower prices?

We are heading towards an economic slowdown, there is no longer any doubt about that. But are we headed for a global recession? Soft, strong? Global recession (consumer caution and a slowdown in the productive forces due to shortages of materials and components) combined with inflation is the perfect cocktail for a sharp decrease in demand. This is the demand shock.

The biggest risk is a sharp Chinese economic slowdown due to major lockdowns disrupting the domestic economy and global supply chains. Last week, the Central Party confirmed the continuation of the zero-Covid health policy. The real estate “crash” is also weighing on growth and should weigh on demand for industrial metals, knowing that before Covid, Chinese real estate absorbed 20%-30% of global supply. Investors are starting to factor this risk, with industrial metal prices having lost between 15% and 30% over the last 2 months.

The ardent defenders of industrial metals underline the very low level of inventories and the growing need coming from the energy transition.

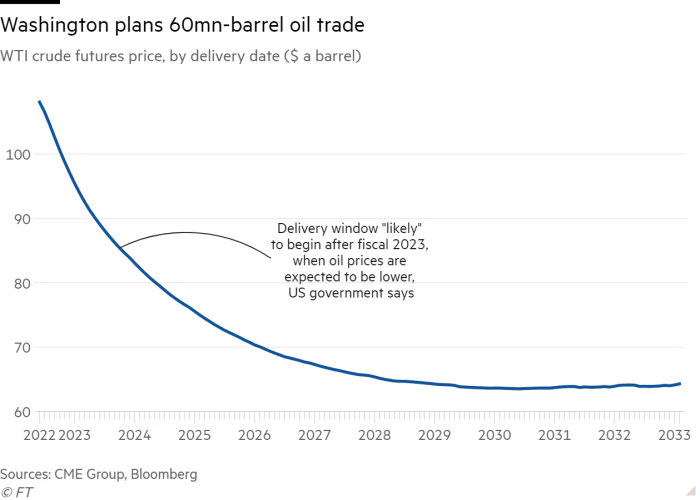

In energy, prices could ease in the second half of 2022 despite OPEC+’s decision to maintain its cautious production strategy. There is more and more talk about a European cartel of gas and oil buyers, like the European states had managed with the Covid vaccines. This idea is not new, but the war is accelerating its implementation. A cartel of buyers would have strong power over prices. The US Administration signs long-term contracts with US producers to replenish strategic reserves. By offering visibility to producers, the US Department of Energy hopes to convince them to produce more.

Europe is getting organized to replace Russian oil and gas. The alternatives will gradually take the pressure off the prices. Italy works with its other suppliers, in particular with producers in North Africa where Italy has always had good relationships. In the coming months, Germany will install four gigantic 300-meter-long floating terminals to import LNG. Despite criticisms, Germany nevertheless reacted very quickly by reducing its dependence on Russian hydrocarbons from 55% at the end of 2021 to less than 35% today; The share of Russian oil fell from 30% to 12%. The main suppliers will be the United States, Norway, Qatar and Algeria. Germany’s objective is to double the development of renewables by 2030. Until now, heavy environmental impact studies had slowed down the expansion of green energies. A special law will allow the authorities to approve LNG-related projects without going through the usual authorization procedures.

- The war and the Chinese Covid health policy are beginning to worry investors with a possible demand shock that could lower the prices of fossil fuels, as well as those of industrial metals

- Compared to sector positioning over the economic cycle, we are gradually taking our profits in energy and metals