Date: 5 July, 2021 - Blog

The wealth effect engineered by the Fed, thanks to its ultra-accommodative monetary policy, is observable not only in equity markets, but also in housing prices. Housing benefitted in two respects from the central bank generosity: through the long-lasting collapse of US nominal interest rates from the aftermath of the 2008/9 crisis and, from last year, through the purchase of Mortgage-Backed Securities.

For now, the significant rise of residential property prices is not worrying, as we are not on the verge of a bubble. Indeed, household mortgage financing is healthy and the short-supply situation, essentially due to pandemics, will gradually normalize with the re-opening of the economy. However, the surge in real estate prices is not insignificant. Housing price inflation is somewhat linked to consumer price inflation, as it raises the buying power of house owners. But, additionally, property prices indirectly impact, with a lag, consumer prices.

Soaring home prices complicate monetary policy

Side effects of housing price inflation

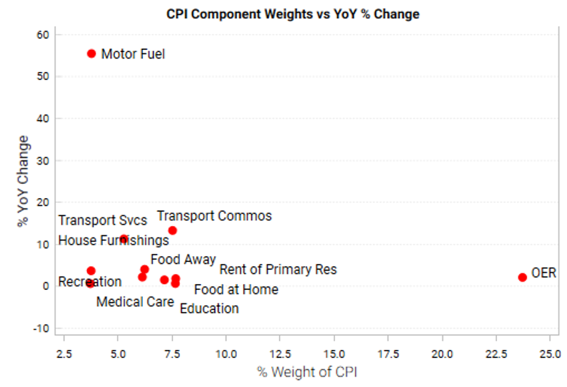

By construction, US inflation indices do not incorporate housing prices per se. This is incidentally also the same in most OECD countries. The rationale is that housing units are considered as a capital / investment and not a consumption item. To consider the housing costs of households, most countries include different types of rent calculations.

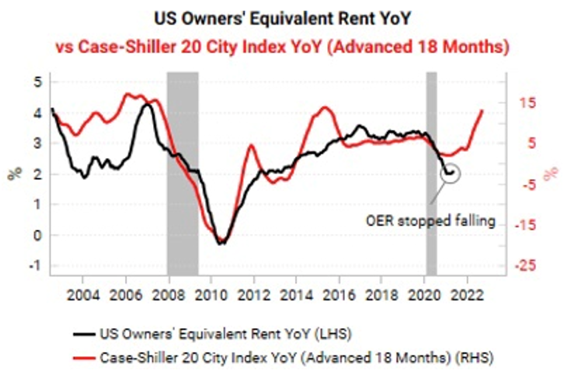

In the US, this metric is called Owners’ Equivalent Rent. Though imperfectly, OER tends to reflect developments in housing prices, with a lag of about 6 quarters. Presently, the Case-Shiller index prefigures a rebound of OER. See graph below. According to estimates from Fannie Mae, the eventual OER rebound should add more than 1.0% to CPI and core PCE from the 2021-end up to 2022-end at least…

Covid has severely impacted millions of renters, namely those who have skipped rent payments or whose jobs have not come back. In this respect a moratorium has been imposed to protect people at risk of losing their homes. A (very) last delay has been granted by the Biden Administration to July-end.

Everything leads us to believe that the rents will rebound from next August

From Q3/4, OER will take over from other strong contributors to US CPI, like used cars

The Fed has been throwing fuel on the fire

Soaring house prices is becoming problematic in many respects. As mentioned above, it will eventually put significant upward pressure on CPI from Q3/4.

Housing weight in US headline and core CPI is significant

Source: Bloomberg, Macrobond, Variant Perception

Rising prices fuels a deterioration of housing affordability, which reinforces the societal tensions, between generations (lucky boomers) and haves between and not haves.

More, this rise in inequalities is opposite to the rebalancing and redistributive policy pursued by the Biden Administration.

The unstoppable rise of property prices means that, ultimately, risks of a boom-and-bust housing cycle are on the rise.

For more than a year, the Fed strongly supported the mortgage market. All in all, the total MBS that the Fed has been buying since April 2020 amounts close to… $2trn! Needless to say that these two processes respectively pushed mortgage rates and their spread to Treasury to an all-time low.

Fed should revisit its purchases of MBS

The quicker the better

Historically Fed intervened earlier

Source : Longview Economics, Macrobond

- A tapering of Fed’s MBS purchase is overdue

- It would confirm the Fed’s preemptive and cautious approach to bubble risks

- There is little time left to act efficiently and in serenity before Jackson Hole meeting (August), which crisps all investors