Date: 13 June, 2019 - Blog

The US Treasury released its semi-annual report on the FX policies

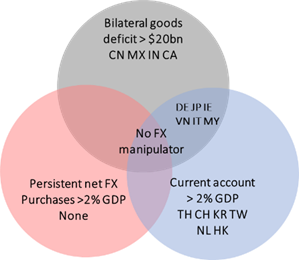

Despite revising the criteria and expanding the universe, it has not labelled any country as a currency manipulator. It put 9 countries (China, Japan, South Korea, Germany, Italy, Ireland, Singapore, Malaysia and Vietnam) on a watch list. Importantly, it did not name China a currency manipulator. Treasury seems wishing to avoid an escalation in the trade conflict. Japan and South-Korea have been , for a long time, on this list.

Some European countries emerge on the watchlist but they are not at risk yet.

Italy, Ireland and Germany cannot be accused of FX intervention as they do not conduct independent FX policy. Fiscal and trade surplus are more related to countries features. The report mainly focused on China even if it met only one criterion. The CNY weakness is a major source of concern along with the widening bilateral trade imbalance. There was little mention of the ongoing trade tariffs. China is quite away from meeting the current account criteria and no evidence of currency intervention has been found. We trust this is likely to remain the Treasury position for a while. Singapore and Malaysia have limited risks of negative impact. The only country at risk is Vietnam as it ran a substantial goods surplus, a highly positive C/A and an active central bank on FX markets.

The global impact will be limited. It seems unlikely the Trump administration will be able to use this report as a supporting tool for its protectionist trade policies. It puts pressure on Europe. China is already in the eye of the storm, but too big to be a victim

USD destiny is not in the US Treasury hands, but much more in the Fed and foreign investors ones