Date: 27 June, 2019 - Blog

Nothing is worse than a central bank admitting it has run out of options

Since he is ECB President, Draghi has shown an impressive determination to act. In this respect, besides a possible rate cut, restarting QE is the most likely option. The ECB has made no secret of its liking of private sector purchasing programs.

Looking at the availability of assets, headroom in other purchasing programs is limited. This is not the case for corporate bonds. So, there are two reasons to be reassured:

Firstly, plenty of options remain in the corporate market. While the ISIN limit was set at 70%, the ECB has currently purchased only EUR 180bn (25%) of the EUR 700bn eligible non-financial EUR investment grade corporate universe, plus an estimated gross supply of 150bn every year.

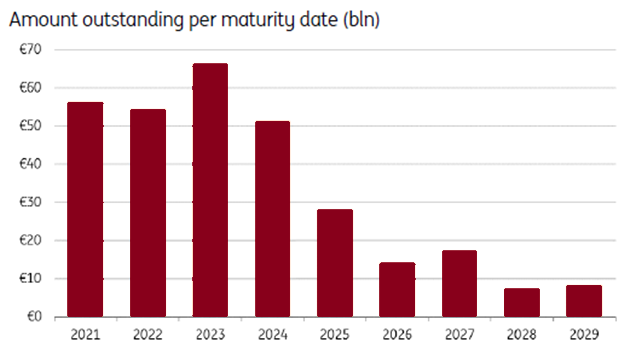

Secondly, this time, bank bonds will clearly be in the scope. The ECB seeks additional assets to target. And in such a process, this will aid the financing cost of banks. Looking at all bonds with more than one-year maturity, this new eligible asset class represents EUR 300bn, plus an annual issuance (up to EUR 100bn) which can also be purchased.

Outstanding bank debt per maturity (EUR bn)

Source: Bloomberg

As it did in 2016, the ECB should squeeze credit market. Credit spreads will be well bid, either due to the expectation of or announcement of CSPP2. Both investment grade corporate and senior bank debt will benefit directly.

- So, to detractors suggesting there is little left in the ECB arsenal, we think otherwise

- European credit market remains a buy

- The banking sector is attractive again