Date: 28 January, 2021 - Blog

In our world of rule of law, debtors must honor their commitments and pay their debts. This is a basic principle, allowing for trade and business to develop in trust. Defaulting is a symptom of failure. In Anglo-Saxon countries, it is more acceptable than in Europe, because the cult of entrepreneurship / innovation spells that risks must be promoted. Trump is the extreme example of it. In Lutheran countries, default is anathema, featuring the definite preference for austerity to profligacy. The political career and unwavering support for A. Merkel illustrates it well.

Both school of thoughts converge on ¨acceptable¨ exceptions: when ¨fundamentally weak¨ debtors face the impossibility to repay. The situation of several emerging / frontier countries spring to mind. Like, closer to us, that of Greece a couple of years ago. Students’ loans in the US will most likely be the next – partial – organized bailout.

But most developed countries will eventually be confronted with such a question in the coming years, following the debt incontinence process that started in 2020 to cope with Covid-19. For now, QE does the trick. Tomorrow, central bank could even monetize new government issuance of Treasuries. Ultimately, the return OF capital will become a key issue!

The topic of (public) debt cancellation is inevitable

Hopefully this will take place in medium-term

De facto cancellation

Central banks have entered a new phase of monetary experimentation. Their quantitative easing operations have increased – considerably – in volume and become persistent. At their maturity, the acquired bonds are effectively ¨rolled over¨. The stock of government debt that they own is therefore constantly rising. Admittedly, there is no accounting write-off of debt. But it is in fact a form of sterilization that does not say its name.

This process protects countries’ credit ratings and reduces the cost of money to governments. Like Japan has done, United States and Europe feel comfortable to continue this exercise for a while longer before a crisis occurs. Let us recall in passing that Japan is taking advantage of a special situation, because most of its sovereign debt is held by the Japanese (both private and institutional), providing a ballast that neither Europe nor the United States enjoys.

Such an arrangement whereby the left hand of the government allows the right one to owe a lot of money is ultimately toxic. But first, pandemic legitimizes unprecedented measures: orthodox / conservative politicians and economists will stay mute over the near term. And second, printing money to ¨cancel¨ government debt is admissible – according to different school of thoughts – as long as there is very little inflation…

It is too early to worry about slippage of monetary policy

But the end of pandemic and a synchronized recovery might prove a different landscape

Tongues are loosening!

BlueBay Asset Management, founded in 2001, is a success-story boutique, i.e. one of Europe’s largest specialist managers of fixed income credit and alternative strategies. By nature, it supports financial engineering and the like. In short, the company does not really qualify as a nest of conservative and orthodox thinkers. Still, its CIO wrote a – highly – surprising article in the FT a couple of weeks ago, entitled ¨it’s time to think about debt cancellation¨. Quite a paving pond in the pond!

He actually refers to a recent episode, when some senior officials asked the ECB to ease the debt burdens by forgiving sovereign bonds it owns: a pure and simple cancellation i.e. a ¨write-off¨. For sure, C. Lagarde immediately dismissed the proposal, urgently followed by other central bankers and economists. But, on the substance, Dowding scores points when he suggests that, to respect convenience/sensitivities, governments should issue bonds with a maturity of … 10’000 years at zero interest! Would it be really less respectable to savers than issuing negative interest rate loans which practically plunder them? On the very principle of historic debt cancellation, one naturally thinks of hyperinflation in Zimbabwe or Germany in the 1930s. However, there are other significant cases: in 1868, at the end of the civil war, the US declared the debt of the Confederation to be zero. Twice, Mexico repudiated its debt (1857-1860 and 1863-1867)…

Public debt cancellation is anathema in principle

But in very special circumstances, it might ultimately prove necessary

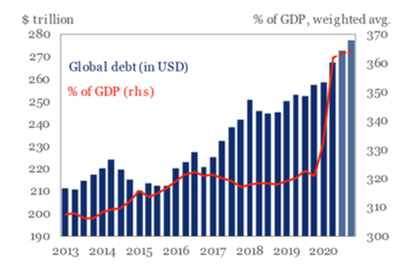

According to the Institute for International Finance, global debt among the advanced nations soared, to approach the unprecedented level of nearly 400% of GDP.

Global debt topped $272tn in Q3 20

Source: IIF, BIS, IMF, National sources

Bluebay rightly considers that cancellation would create major financial shocks, through a reconstruction of a risk premium. Sovereign yields would experience a sharp and sudden rise. One should differentiate between two scenarios:

- The worst if governments were to unilaterally default on some of their debt. This would create a major shock to the global financial system…

- The most benign if a central bank decides canceling some sovereign debt it holds. It would mechanically provoke an accounting loss of the same magnitude. Therefore, any such initiative must be put in the perspective of the actual net worth of a central bank. The Fed, for example, has an advantage compared to peers, as it could reevaluate its significant gold reserve to market prices, to compensate for part of it.

The most pragmatic thinkers argue that, to avoid a dramatic confidence crisis, safeguards are necessary: calibrating the size scope and duration of operations, implementing a clear legal / constitutional framework, etc. But let us face it: preparing for such safeguards would equal telegraphing to markets the will to write-off debt. Probably impracticable in practice.

There would be an undeniable first-mover advantage for the country which decides first for it

Success would rather imply to rely on the surprise effect / fait accompli

- In 2021, the debate on – public – debt cancellation will move from the circle of specialists to mainstream

- As soon as the pandemic is over, it will put growing pressure on governments

- Despite major fiscal stimuli, central banks will remain in the very spotlight medium-term