Date: 16 March, 2020 - Blog

What a nightmare…

Last week proved awful for financial markets to an extent that what not seen since the Great Financial Crisis of 2008/2009. All asset classes fell heavily, in relentless waves, except for most of sovereign bonds and, to a lesser extend, of gold. As usual in the context of severe markets’ dislocations, cross-asset correlations and volume of transactions spiked. This is a harbinger of panic-selling, by both long only and more speculative (say sophisticated institutions like leveraged players and hedge funds). Did we reach a phase of catharsis?

Policy-makers failure

Obviously, the global spreading of the Covid-19 virus and the risks of an uncontainable collateral sanitary crisis have been at the epicenter of global fear. It has become now obvious that the nascent economic recovery of Q1 will – at best – give way to a S1 cyclical downturn. But, unfortunately, key policymakers are adding fuel to the fire.

- First, the two sequential Fed emergency cuts in a few days have resulted in growing investors’ fear. Size of liquidity injections and level of policy rates will not address the nascent credit and solvability crisis. This is even more striking in a world where global coordination (among G7 leaders) has evaporated…

- Second, the irruption of oil price war – courtesy of the odd Putin/MBS couple – is raising the spectrum of a credit credit crisis, among US shale producers and, ultimately, US banks.

- Then Trump administration hasn’t quite taken on early enough on the issues of the situation. Its preliminary response – banning flights from Europe – is essentially designed to blame others for the responsibility of US upcoming sanitary crisis.

- Finally, the ECB failed to invent a new bazooka, but rather held EU governments responsible for adequate action. C. Lagarde, the head of the ECB, even said that it wasn’t her job to narrow spreads between the sovereign bond yields of countries at the periphery of the euro zone and those at the center. It immediately led to a sell-off in Italian bonds…

Old policy makers’ remedies do not tackle the current nasty – multi directional – schock

Inadequate responses of decision-makers risk igniting further markets’ collapse

Relentless waves of deleveraging and downgrades (if not defaults) are the harbinger of a credit crisis

The Great ¨unknown¨ of forced sales

Markets experienced huge transaction volumes in the past two weeks. This is usually a symptom of exhaustion / capitulation. Still, the markets’ paradigm has changed. Indeed, the prominence of passive investment vehicles and of algorithmic trading are rendering more difficult the interpretation of these large volumes.

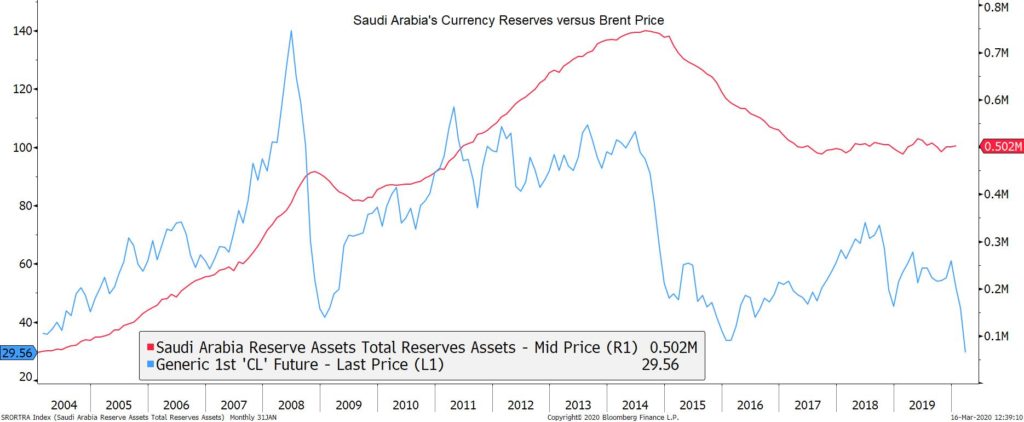

Lately, the 10-year Treasury yields resurged widely to 0,9%, from an all time low of 0,3% a couple of days ago. This rebound suggests that someone must be heavily selling Treasuries. This could be corroborated by the very recent fall of other safe haven assets like Gold, the CHF and JPY etc. Actually, sales of haven-assets can result of some big players being in trouble. Among the unusual suspects, one should now include the oil countries sovereign wealth funds. For instance, Saudi Arabia’s reserves are dependent on gyrations of the price of oil: Riyadh reserves decline when the oil price goes down… So one can assume it may have started to sell some of its reserves / Treasuries because of current oil market setbacks.

Source : Bloomberg

Capitulation? Not quite yet

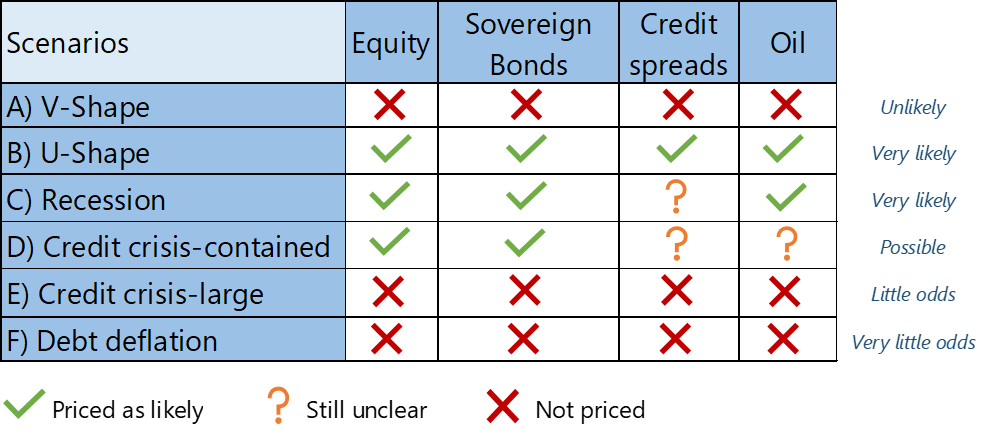

According to the developments of financial markets, an economic recovery is no longer expected (A). Most assets rather discount a significant deterioration of growth i.e. a ¨thick U¨ shape, if not a quick recession (B, C). But an additional widening of credit spreads, if not a closure of large funds / ETF may still lie ahead (D)…

Still, markets do not discount a more dramatic scenario that may eventually unfold if policy makers prove incapable of changing dramatically tack (E, F)

Signals given by different asset classes

- The premisses of a credit crisis leave no room for complacency

- A tentative stabilization and lower correlation could only be expected if different measures and policies are immediately implemented

- Eurozone/ECB must protect/ringfence the banking sector with formed guarantees

- Helicopter money, central banks buying of private bonds (banks, airline, cruises, shale producers, etc.) must be urgently implemented

- Absent this, a severe credit crisis / a debt deflation would eventually provoke further collapse of markets