Date: 13 August, 2018 - Blog

Since 2009, Chinese stocks have experienced 3 bear markets! The last one, in which we are now, is due to the trade war between the United States and China, but not only: the economic figures point to an economic slowdown. Moreover, China is in a process of debt reduction, which translates into lower liquidity.

The 3 bear markets of Shanghai Shenzhen CSI 300 Index

Source: Bloomberg

Chinese officials concede that Trump’s attacks go much further than they thought. The central bank has lowered its policy rates and reintroduced rules that makes more expensive to bet against the renminbi, in order 1) to face the risk of a more pronounced than expected economic slowdown, 2) to halt the decline of the renminbi and 3) to boost the stock market.

The “dilution” effect is also weighing on the Chinese stock market indices: over the last 5 years (see chart below), the Chinese stock market faced a gigantic dilution effect due to a massive capital increase, mainly from State companies (SOEs) to strengthen their balance sheets. In China, 82% of listed companies were concerned by this dilution, increasing the number of shares outstanding by 50%.

Despite the opening efforts, China suffers from lack of access to domestic shares (A-shares) for foreigners. Moreover, Chinese domestic equities are practically not included in global indices, while Chinese market capitalization is the world’s third, behind the United States and Japan.

The (very progressive) integration of domestic equities by MSCI is essentially the recognition of a growing demand from foreign investors, but much less the result of improved corporate governance, financial transparency or shareholders’ protection. MSCI also mentions that some Chinese companies use off-shore legal structures (such as Alibaba) to remove shareholder control, thereby increasing legal uncertainties.

Foreign investors are holding only 2.7% of the capital of domestic Chinese companies against 26.3% in Taiwan, 30% in Japan, 34% in South Korea, according to JPMorgan Asset Management.

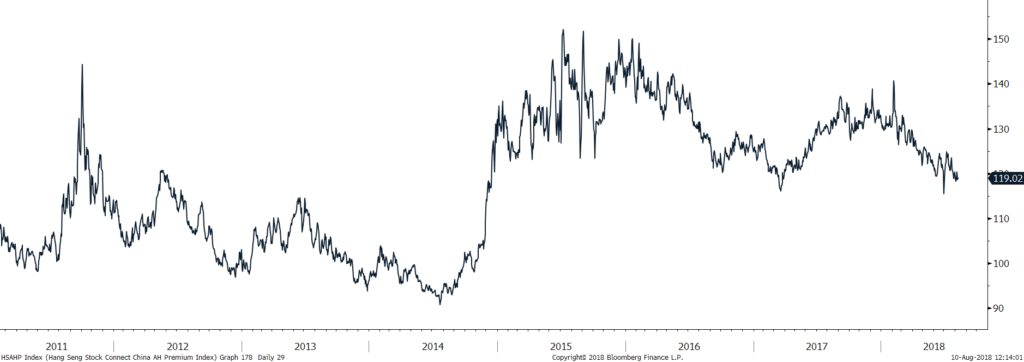

In 2014 and 2017, the premium of domestic shares (A-shares) compared to Chinese stocks listed in Hong Kong (graph below) had increased thanks to Shanghai Hong Kong Connect, then Shenzhen Hong Kong Connect. Without further major stock market reforms, this premium should continue to decline.

The Chinese stock market needs a real liberalization and less interventionism from the government before the international flows enter massively into the A-shares. In 2015, the Chinese authorities halted the listing of half of the companies and severely punished short selling, decisions that had cooled foreign managers.

Hang Seng Stock Connect AH Premium Index

Source: Bloomberg

- We stay in neutral on Chinese equities

- The absence of an oversold technical situation does not prevent from further declines in Chinese indices