Date: 17 January, 2019 - Blog

The Russian 2018 CPI settled in at 4.3%, exceeding slightly the central bank target.

This does not necessarily mean a key rate hike is imminent, as the recent hike to 7.75% was presented as preemptive by the CBR. This acceleration can be attributed to anticipated effects of the VAT hike and the food component. Following the hike in VAT from 18% to 20% effective on January 1st, the Russian CPI over the first 10 days of 2019 increased by 0.5%.

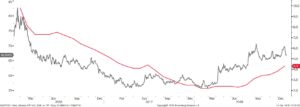

The initial reaction appears moderate, but it will take 3-6 months to fully assess the pass-through. The RUB has depreciated by 17% over the previous year. Over the time, the RUB tends to follow the CPI dynamic. It is already discounting too much bad news.

The Finance Ministry just announced that it will purchase RUB 266 bn ($4.0 bn) worth of FX on the open market from January 15th to February 6th. The amount is a function of the expected excess fuel revenues. It is slightly higher than expected. The decision to restart FX purchases on the open market was already announced in mid-December.

Therefore, it is not a surprise. Some investors expressed concern that the restart of FX purchases could negatively affect the RUB. We do not share the view. In theory FX interventions and growth in central bank reserves, all else being equal, could cause the currency to underperform. In Russia, there are strong factors to ensure that this does not happen: 1) the FX intervention amount is not large enough to offset the current account surplus, 2) the RUB is already cheap and 3) the global emerging market risk sentiment and geopolitics are much more important.

- Buy the RUB