Date: 25 October, 2018 - Blog

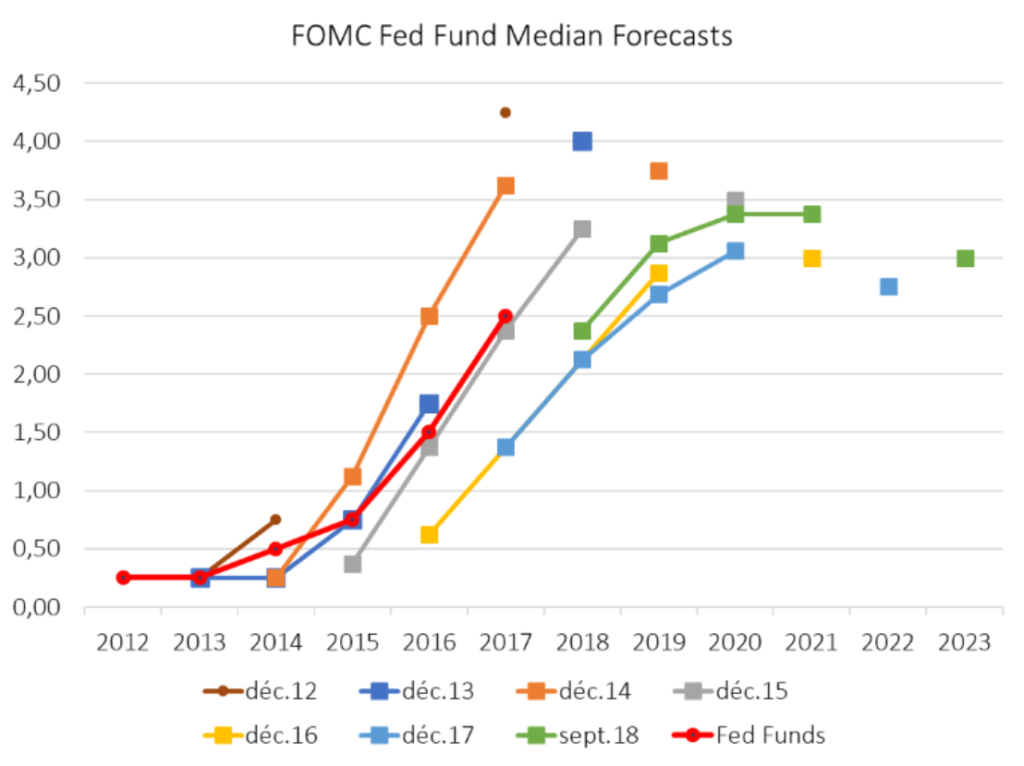

As expected, the FOMC minutes revealed that the Fed is on track to deliver 3 additional rate hikes until it reaches the 3.0% neutral rate. Our scenario remains for one hike in December, one in March and the latest one in June 2019. At that time, the monetary policy will be more dependent on economic and markets developments. The Fed should therefore be on hold. There were no discussions about the target for the balance sheet size at the end of the quantitative tightening or regarding the future monetary policy framework. Almost all the FOMC members considered appropriate to remove the reference to the accommodative stance of the monetary policy.

The removal is not signalling a policy stance change while having waited too long would have given a false signal on the current stance. Finally, the minutes did not give any indications that the board had been influenced by the recent criticisms from President Trump. The different views on how high the Federal Funds rate should go are laid out clearly in the dots.

The Committee’s median estimate of the long-run neutral rate is at 3.0%. Nine of the board members think the federal funds rate should be above 3.0% by 2019 year-end, while only six think it should be below that level. The big question is to know if the FOMC is over-optimistic? During the 1992-2017 period, the FOMC tended to over-forecast GDP growth and the unemployment rate and by consequences to overestimate the long-term targeted Fed Fund levels.

Source: Heravest

As expected, the Trump administration did not officially qualify China as a currency manipulator, despite Trump claiming for it. China simply matches with one of the three criteria (i.e. the first one):

- A significant bilateral trade surplus with the US of at least $20bn,

- A material current account surplus of at least 3% of GDP,

- Persistent, one-sided intervention, which occurs when net purchases of foreign currency are conducted repeatedly and total at least 2% of an economy’s GDP over a 12-month period.

Still, the report included very aggressive language against China. It is difficult to see a solution to the trade war/strategic conflict in the short term, as the US economy is solid, and China does not want to negotiate under pressure and seems to be preparing for a long fight. The next round of central bank meetings begins with the Bank of Canada and ECB this week. The BoJ and BoE follow the week after and lead into the US midterm elections and the Fed.

- The US mid-term elections will shape fiscal and trade policy for the rest of the Trump term

- Short-term currency market reactions should differ from long-term perspectives