Date: 22 November, 2018 - Blog

US inflation bounced back in October, with the largest monthly gain since January, as widely expected. On a year-over-year basis, inflation is up 2.5% compared to 2.0% last year. Higher energy costs were a driving factor in the pickup in inflation. Gasoline prices were up by 18% from October 2017 to October 2018, and they were slightly higher in November 2017. Since the beginning of the month, gasoline prices have dropped.

After a light disappointment in August and September, core inflation rose 0.19 % in October. However, core CPI on a year-on-year basis has just reached its lowest level since last April. The 2018 USD strengthening should keep goods prices from rising rapidly even as tariffs begin to seep into prices in the coming months.

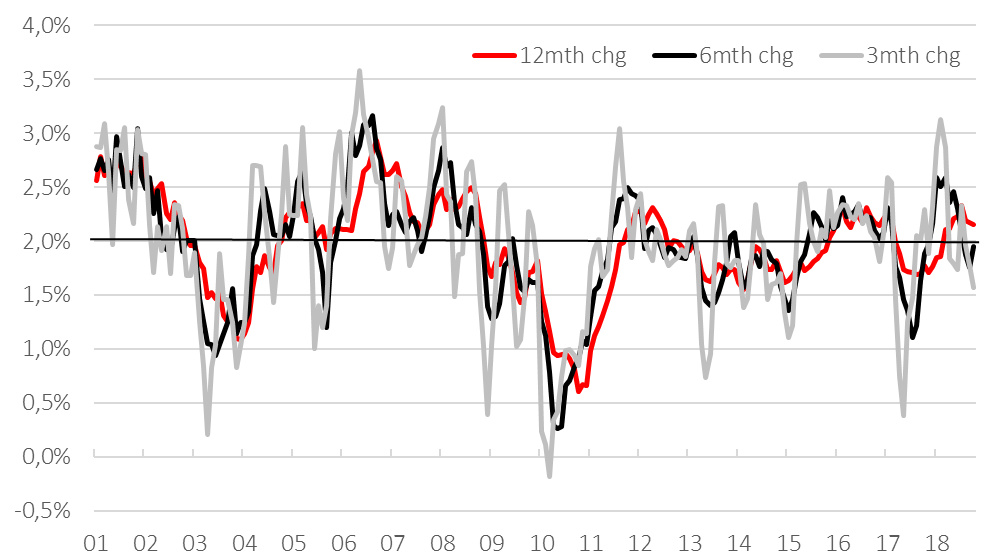

US Core CPI

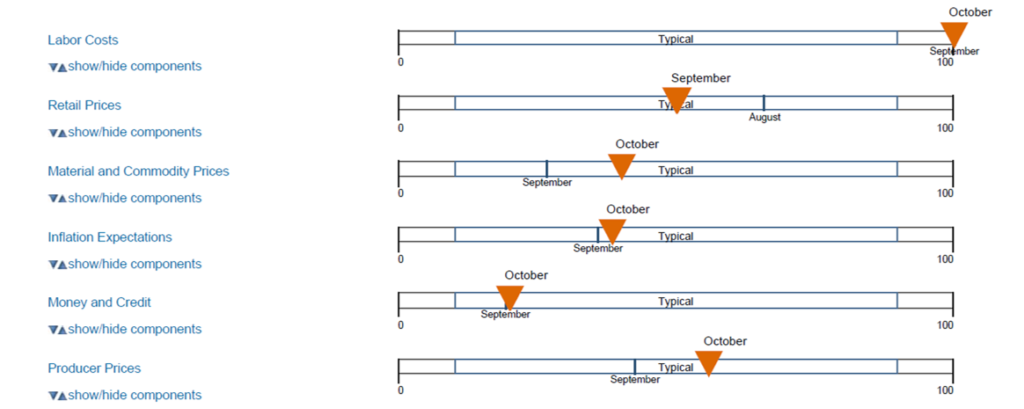

The recent oil prices plunge will drag down inflation, but there is still some room before reaching levels inconsistent with the Fed’s target. The T2/T3 rebound in core inflation suggests the underlying trend remains modestly higher. According to the Atlanta Fed inflation dashboard, except labor costs, all the other 5 broader categories are pointing for an inflation deceleration.

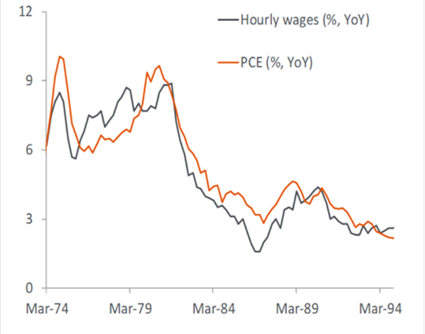

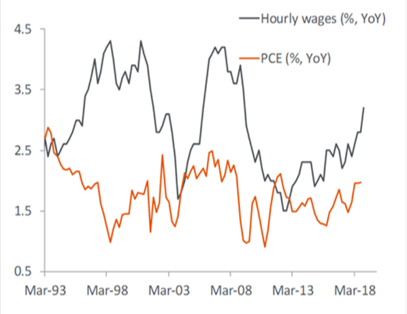

However, according to the Bureau of Labor Statistics data, prior to the early 1990’s wage growth and consumer inflation were strongly correlated, but the relationship seems no longer valid since mid-90’s.

70’s and 90’s

Recent decades

In that context, the US 10-year breakeven turn back to 2.0%, its January levels when 10-year Treasury yield was around 2.60%. The Fed is convinced that the Phillips curve is alive and kicking, and hence is ready to tolerate some undershooting of inflation numbers. All these developments happened at a time, the Fed Funds and US 3-month bills yields are for the first time since 2007 above the core CPI, highlighting a close to neutrality, if not restrictive, monetary policy stance.

Powell was interviewed by Dallas Fed president Kaplan and repeated his familiar upbeat view on the US economy, albeit without great details . Perhaps most notable was his response to a question on the impact of the equity market on monetary policy. Powell carefully noted the reasons why large equity moves can impact the real economy. He added that the stock market is only one of many factors. This seems a very clear message that the Fed is losing very little sleep over renewed equity weakness.

The USD strengthening was due to an unprecedented yield spread widening thanks itself to a much aggressive Fed hiking pricing. Amongst the reasons there is the US fiscal stimulus and a still very accommodative stance abroad. The stimulus effects will fade, leaving the US with a sizeable twin-deficit problem and exposing it to a rise in US risk premia. This should be USD-negative. Additionally, global growth justifies much more rates out of the US.

- Fed hiking pattern to slow in 2019

- A strong USD-support is vanishing, we turn bearish on USD