Date: 8 January, 2021 - Blog

There was a global splurge in government borrowing in 2020 and emerging markets were not left out. However, given the context, much of the borrowing took place domestically and in local currencies. Last year, EM countries response was different than their traditional way of thinking. Central banks have cut rates and governments borrowed more cheaply. Some of them have approached the zero rates level, enlarged their central banks remits, and embarked into QE-type policies to safeguard liquidity or for financing pandemic-related spending.

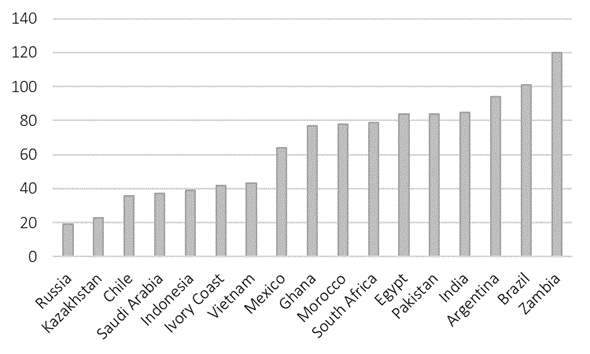

Surprisingly, only 6 EM countries were downgraded in 2020. Some due to severe solvency risks (Argentina, Lebanon, and Zambia) and others because they were particularly hardly hit by the pandemic (Ecuador, Belize, and Suriname). While their indebtedness has risen, most have not reached levels compatible with imminent systemic debt crisis. The larger emerging countries have borrowed mainly on local markets often thanks to foreign flows. Only the mostly frontier countries have heavily borrowed externally. Therefore from an investment prospect, country selection is key, as there is huge variance between countries.

Public debt (% GDP)

Source: Bloomberg

EM bonds suffered from large outflows in March 2020, but financing flows recovered and ended the year in positive territory. However, the pace of local bond fund flows was initially slow and only began to pick up with any conviction as the outlook of Biden taking office has provided the market with hopes of an “end” to tariff wars.

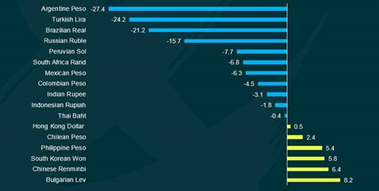

This trend was further boosted by the positive vaccine news. Better economic data in Q3 and investor positioning helped even some of the hardest-hit emerging market currencies recover in Q4. EM currencies bore much of the adjustment brunt early in the crisis but tended to recover over the course of the year. Currencies have rallied since November, as risk on sentiment has taken hold. The usual suspects (BRL, MXN, ZAR, and RUB) have outperformed since then.

Currency returns in 2020 vs. USD (%)

Given our softer USD forecast, this would give EMFX a boost given emerging market local debt higher yields. However, any unexpected weakening in the global economy would fuel a moderation of investor interest.

Despite the pandemic, 2020 saw record foreign inflows into the Chinese local bond market following its global bond indices inclusions. We believe this trend is set to continue and is likely to create new investor demand given its higher yield level.

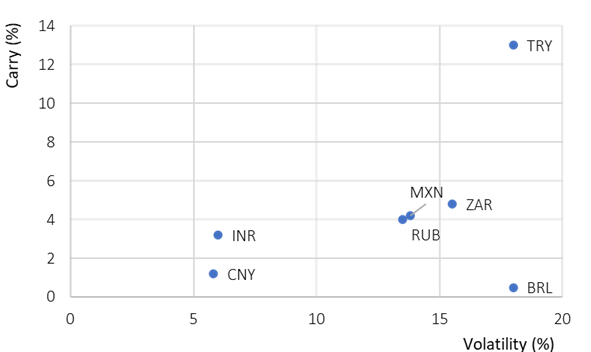

The EM currencies sensitivity to vaccine announcements clearly shows a positive relationship between positive vaccine news and most EM currencies. Surprisingly, China and India did not participate to the rebound. The INR does not appear to strongly react that to vaccine news, but it remains a top pick from a carry to volatility perspective.

If one is bullish on the vaccine timeline, positioning towards MXN, ZAR and RUB provides strong options with a fair amount of carry to vol and a clear spot sensitivity to further positive vaccine news. The BRL positioning does not provide a high carry if the spot performance struggle to deliver. It is still unclear if Brazil will have a vaccine roll-out in place to mitigate the winter Covid-19 season from April onwards.

Carry to Volatility

- Recovery is underway, there is the potential for some catch-up amongst EM currencies

- Our favorite picks amongst EM remain China, Russia, and potentially India