Date: 16 October, 2020 - Blog

Large US firms are already starting to pay back the $350 bn that investment-grade corporates they have issued in 2020 to get through the pandemic. Target and CVS Health have recently announced that they are buying back their bonds, using cash plus in the case of CVS, some borrowed money as well. Even AT&T, one the most US indebted firm, has announced last month it is planning to use excess cash to further cut debt. It is still unclear how many companies are going to join this trend.

Investment-grade companies have seen their indebtedness rising to a record high in Q2 2020. Their financial leverage, i.e. the ratio of debt to Ebitda, has climbed to 4x. Since early 1990, the ratio has ranged between 2x and 3x. This is the first time it has jumped so quickly. This has been caused by lower Ebitda, due to lockdowns and lower revenues, but also to a high proportion of firms using preventively cheap refinancing to secure some cash on their balance sheets. That unusually high-level worries investors. It explains why some companies are eager to pay down borrowings. Even if the Fed is supporting credit markets, it will not last indefinitely. The Fed buying pace has slowed down considerably. The Fed is now only buying short-term debts against purchases of ETFs in March.

Source: BofA Global Research

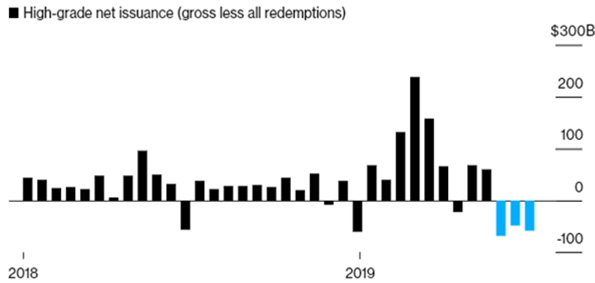

High-grade companies have found that the cost of moving out of investment grade category is costly. That is leading to a gradual erosion of quality that is difficult for firms to get out of, when faced with a major economic shock, and many companies came into the pandemic with too much debt anyway. According to BoA, high quality US firms in Q4 will probably pay back more than the $350 bn they have borrowed earlier in the year. Companies that are performing relatively well during the pandemic are more likely to be comfortable paying back debt. Meanwhile, other industries (travel, leisure) are likely to wait until the economy recovers.

- Credit fundamentals are no longer deteriorating

- Credit is still attractive