Date: 11 September, 2020 - Blog

It seems like we are back where we were at the beginning of the year

Investors could be tempted to expand their scope to less popular asset classes which can seem cheap. However, in most cases they are cheap for good reasons. Emerging assets are amongst those assets that look always cheap, at least in relative value, as they are offering higher yields/spreads than their developed peers.

First, the EM universe is broad and diversified. At the top end, Israel, South Korea, and Taiwan are still included into EM indices. At the bottom end is India, a country with enormous potential if it can overcome its enormous structural problems. There is a solid group in the middle with varying levels of institutional maturity and political freedoms. Then, the universe has recently experienced numerous defaults like Argentina, Barbados, Ecuador, Mozambique, Puerto Rico and Venezuela. Furthermore, Fitch sees Gabon, Mozambique, Congo, Suriname and Zambia at high risk of short-term default. Finally, a long list of countries in Africa, the Middle East and Latin America, which are running substantial budget deficits, are hoping for a massive oil price increase to save them.

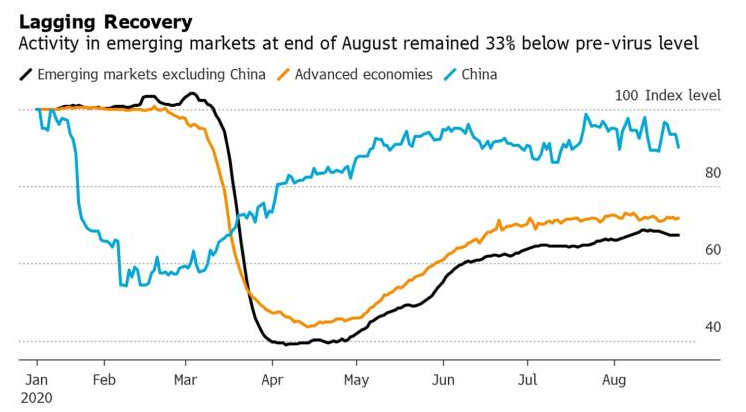

Economic activity fell faster and deeper in EM economies than in advanced ones during the COVID episode, and the recovery is proving slower and shallower. At August-end, according to Bloomberg, EM countries activity index ex-China remains one third below its pre-crisis level. China, Russia, Turkey, and Brazil have made the most progress, while the rate of recovery in major Latin American countries has been much slower.

Source: Bloomberg

On year-to-date basis, emerging currencies are underperforming advanced nation by a record. From February to May, EM currencies have set a succession of new lows. Since then, they have recently rebounded on the back of a weaker USD. They are poised for a third monthly advance, their longest winning streak since January 2019. While Fed Powell policy shift has helped to boost risk-taking in recent sessions, there are several danger signs suggesting their recent gains may be about to end.

Concerns surrounding the economic impact of Covid-19 on EM and their ability to deal with a prolonged crisis still dominate investor sentiment. This has led to prefer developed market assets over EM ones. A rapid volley of interest-rate cuts to combat the pandemic has also reduced their attractiveness in absolute and relative terms. The index that measures returns from borrowing in USD and investing in 8 high-yielding EM currencies is below its 10-year average after dropping to a decade low in April.

Bloomberg EMFX carry index

Source: Bloomberg

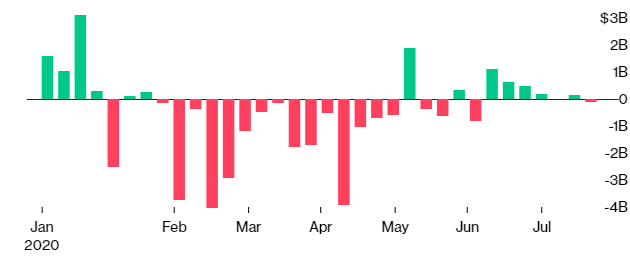

EM stocks and bonds ETFs have seen combined outflows of $16.5bn this year.

EM ETFs (bonds & equities) monthly flows

Source: Bloomberg

- EM carry trade is ¨dead¨

- Avoid EM currencies and local currency bonds as they failed to stabilize