Date: 9 July, 2020 - Blog

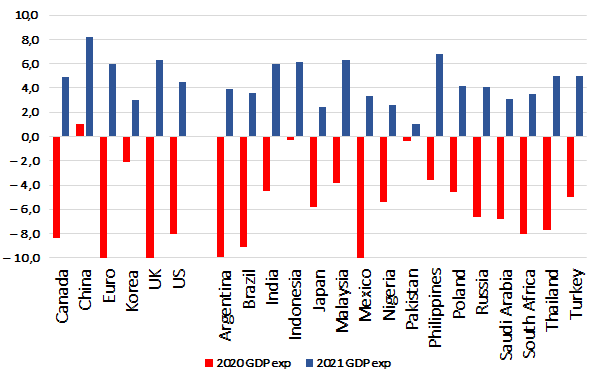

The latest IMF World Economic Outlook provides a valuable snapshot amid the ongoing pandemic. Compared to last April, it paints a deeper recession in 2020 (-4.9% vs -3.0%) and a more modest recovery in 2021 (+5.4% vs +5.8% in April), meaning that it will take longer for the global economy to recover lost output while plenty of uncertainty remains. The 2020 slump in developed economies is deeper (-8.0%) but growth has been slightly revised up for 2021 (+4.8%).

Few countries will be able to recover quickly the 2020 fall

Source: IMF, Heravest

We remain concerned about the growth outlook in many emerging economies. Altogether, they will contract by 3.0% this year with a depressed and delayed recovery in 2021 (+5.9%). Notwithstanding, the heterogeneity means that deviations across regions and countries will be substantial. Asia (-0.8% in 2020) faces a more modest contraction, with China holding up thanks to many launched stimuli. Asia remains best positioned for the recovery with growth seen recovering to 7.4% in 2021. Latin America (-9.4% in 2020; +3.7% in 2021) will face the most challenging environment, with Argentina, Brazil and Mexico facing a GDP contraction of around 10%. In between, we have EM Europe (-5.8%; +5.3%), Middle East & Central Asia (-4.7%; +3.3%) and Sub-Saharan Africa (-5.4%; +2.6%).

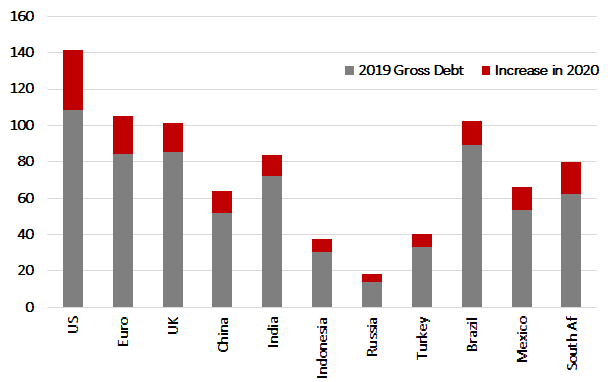

Even if expected economic rebound in EM countries looks solid, most of them have limited fiscal scope with debt sustainability at risk. In response to the Covid-19 outbreak, most economies have followed a combination of containment measures and policy stimulus. Fiscal balance sheets are seeing a meaningful deterioration in 2020 due to the weak growth outlook and larger fiscal deficits.

Global gross debt/GDP is expected to rise from 82.8% in 2019 to 101.5% in 2020. Both the high absolute number and the increase over 2020 are skewed upwards by advanced economies (with debt/GDP seen increasing from 105.2% in 2019 to 131.2% in 2020). Emerging markets, on balance, carry a much lower debt burden and see a reasonably modest increase (from 52.4% to 63.1%).

Yet, it is here that we are more concerned about debt sustainability, as many advanced economies benefitfrom reserve currency status and ultra-low interest rates, while EM countries still have a significant part of their indebtedness in hard currencies, and local debt have higher interest rates.

Source: IMF, Heravest

Fiscal deficits for emerging market economies are expected to be huge if not unmanageable. Brazil (-16.0% of GDP), South Africa (-14.8%), China (-12.1%), India (-12.1%) and Saudi Arabia (-11.4%) will run deficits above the 10% of GDP threshold. Mexico’s deficit is lower at 6.0% of GDP but the deep recession means that it will join the above mentioned to see gross debt/GDP rising by more than 10ppt.

- The current number of Covid-19 cases is moving in the wrong direction across EM economies

- Some of them are launching light QEs

- Their track-record is not supportive and will refrain investors demand for sovereign EM government