Date: 17 October, 2019 - Blog

Donald Trump lost. In launching his trade war against the whole world, he said that “a trade war is easy to win”. Against China, he wanted A big global trade agreement or nothing, he had time, but today he has to settle for phase 1 of a trade agreement. We are not fooled: his “great qualities” of negotiation simply make it possible to return to the situation that prevailed before the trade wars, as for China or the great USCMA agreement, roughly equivalent to NAFTA.He must be content with a partial agreement with China, because he has no time. He must quickly show a victory to his voters, because he is losing on several fronts:

- Procedure of impeachment by the Democrats of the House of Representatives.

- General animosity (even of the closest Republicans) facing his posture in Syria.

- A federal court requires Donald Trump to provide his financial information to Congress.

- A judge said that Donald Trump was breaking the law by using Pentagon money, with the argument of national urgency, to build his wall between the United States and Mexico. The decision to build a wall is the responsibility of the Congress.

A partial agreement, and then? What about past rate hikes? Will Donald Trump remove them? And the possible financial war announced 2 weeks ago? Will it penalize Chinese companies listed in the United States? This phase 1 of a more global trade agreement will not prevent the economic slowdown, and especially not the decline in profits in 3Q19. We enter into the majors on Tuesday 15th and Wednesday 16th with the results of major US banks and Netflix (Wednesday).

According to CNBC Trade index, US companies the most exposed to China by revenue :

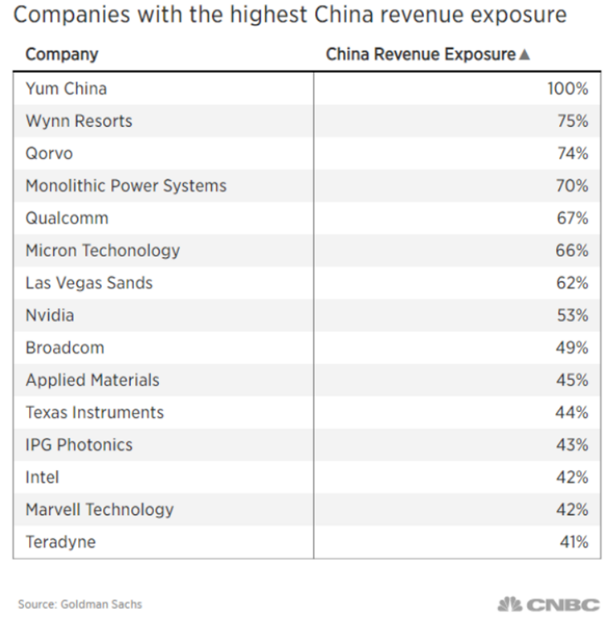

According to Goldman Sachs, US companies of the Russell 1000 with the largest exposure by revenue to China :

- A US-China trade agreement, even partial, is positive in the short-term for the stock market

- Further rise of interest rates would be positive for the Value segment, banks and industrials leading the way. But we still need US 10y government bonds to break through 2% for the value segment come back to be durable

- If the dollar falls, this is positive for emerging and European equities

- In the case of a Brexit with agreement, companies like Lloyds Bank, Royal Bank of Scotland, Kingfischer or Next would be favored

- But these bullish movements are very tactical so far. Indeed, the risk of recession in 2020 remains