Date: 22 March, 2019 - Blog

The Maneuvering Characteristics Augmentation System (MCAS) of the 737 Max 8 and 9 is in question. Before and after the 2 accidents of Lions Air and Ethiopian Airlines, several American pilots had reported a malfunction of this device. Boeing will install a fix in the next 2-3 weeks.

The 737 Max is the plane that has known / knows the biggest success, with 5,000 planes on order. According to analysts, the 737 Max should account for 30% of Boeing’s revenues and 40% of profits in 2020 when the 737 Max goes into full production. The total bill is difficult to determine, but of the 385 units in circulation, it is estimated at $2-3 billion, including compensation to airlines, and even $5 billion for some analysts. Air Canada, one of the companies most affected by this grounding, has announced a significant impact on its results in 2019. The cost will also depend on the duration of the grounding. But on the financial side, this serious crisis is manageable for Boeing, which generated operating cash flow of $15 billion in 2018 and free cash flow of $13.6 billion.

In terms of safety, the two accidents are major for Boeing, but it does not call into question the 737 Max program. In the single-aisle segment, there are only two manufacturers, Boeing and Airbus. There is also the Chinese Comac C919, but this plane is not yet on the market because of delays and orders come exclusively from Chinese companies. On the reliability of the 737 Max, Boeing will have to convince the regulator, airlines and end customers, those who board the plane. Once the problem is resolved, it is not certain that the Federal Aviation Administration (FAA) and the other regulators will immediately stop the grounding.

Boeing and the FAA seem to have been very complacent with the 737 Max allowing it to fly while pilots were not trained with the new software. The FAA’s strong reputation took a hit, while it was Donald Trump himself who gave the grounding order of the 737 Max.

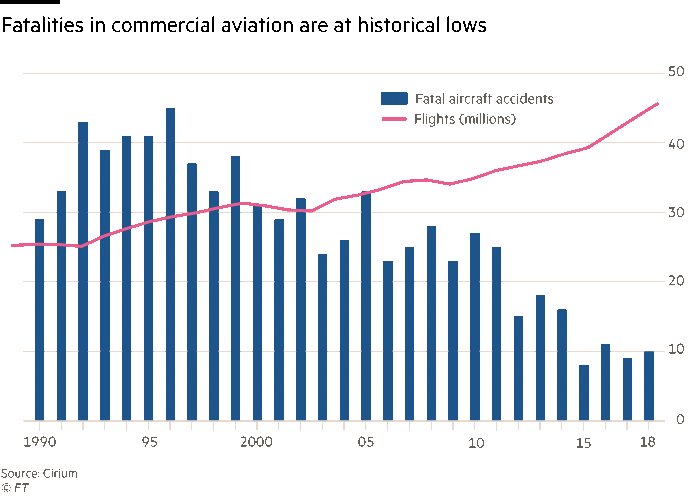

Despite the 2 accidents of 737 Max, accidents

are at historic lows thanks to technology

The Boeing share price has fallen 11% since March 11th. The grounding could last between 3 weeks (the most likely scenario) and 2 months. The single-aisle segment is of major importance for both Boeing and Airbus as well as for the airlines.

Support on the 100D and 200D MACD

- We are starting to buy Boeing with a valuation of $450 per share