Date: 22 October, 2018 - Blog

On the stock market, the Automotive sector lost 20% in 2018. Equipment manufacturers lost more with -38% for Continental or -50% for Valeo. After the cheating on diesel engines, the automotive sector is facing a major technological transition over the next 10 years and new tough standards on CO2 emissions. In addition, in the short term, they are under pressure because of trade war (import tariffs and steel and aluminium prices increases), Brexit and protectionist measures that they can’t manage. Everything is going so fast that the automotive sector is undergoing profound structural changes.

Consumers are also upset: in August, car sales in Europe jumped 31.2% to drop 23% in September and 39% annualized and seasonally adjusted. Volkswagen has announced a sales decline of 37% in Europe and 18% worldwide. In China, car sales fell 11.6%, the largest decline in seven years, and rose 1.5% in the nine months of 2018; however, the contraction in China has accelerated in the last 3 months and we could see a decline in sales in 2018, the first decrease in 30 years!

Diesel engines will be banned from major European cities between 2024 and 2030. Total ban on diesel in Oslo in 2019, Copenhagen 2019, Barcelona 2020, Paris 2024, Rome 2024, Athens 2024, Brussels 2025, Amsterdam 2025, Madrid 2025, Milan 2030, etc. … From 2019, the big German cities, Berlin in the lead, will partially ban diesel. The drop in diesel sales is impressive between -20% and -30% depending on the country. In Europe, the market share of diesel has decreased from 55% to 36% in 1 year! If diesel technology were to disappear in the near future, an unquantifiable consequence today could be value patches on patents.

So for consumers, what to buy ? Gasoline engines or hybrids/pure electric, the latter still being too expensive? To buy or wait some years to have a greater choice of hybrids/ pure electricals and lower prices? And pure electric cars, yes, but the charging network is not large enough; this is one of the reasons why pure electric cars are still so expensive (another reason is economies of scale): manufacturers do not want consumers to buy them today aggressively because consumers would be very unhappy, especially during holidays, faced with traffic jams in front of the charging stations.

Governments are hardening the rules on CO2 emissions, pushing manufacturers to produce electric cars, but these same governments do not have a real policy to support their development by pushing the infrastructure in charging stations. Worse, they are reducing tax incentives when buying clean cars, i.e. France, Britain, justifying a control of public deficits and sending a confusing signal to future buyers of cars. In Europe, there are 200’000 charging points and it would need 2.5 million in 2025 according to the European Automobile Manufacturers’ Association. It will also need terminals that recharge the whole batteries in less than 10 minutes; today, the best performers recharge half in 30 minutes.

Constraints on CO2 standards. The new Worldwide Harmonized Light-Duty Vehicle Tests (WLTP) have delayed the commercialization of many models. Europe has just decided a 35% reduction in CO2 emissions in 2030 for the automotive sector, while the automobile industry demanded 20%. Some countries, where there is no car production, required a reduction of 40%. A major challenge for builders which warned that this could have consequences such as massive layoffs or financial losses. In Europe, 13 million people work for the automotive industry.

Investments in new technologies – electric cars, batteries, connectivity, car autonomy and charging stations – are going to be gigantic, so there is obvious stress for automakers and equipment manufacturers, and financial risks. Margins will be under pressure because they are lower for electric cars than traditional cars. It will have to absorb the costs of R&D of new technologies, even if some will be amortized by the subcontractors (batteries, connectivity, autonomy). Economies of scale are expected only around 2028-2030, so a significant decline in the selling prices of pure electric cars.

Europe needs a “battery champion”, while Asia and the United States are far ahead. China, Japan, South Korea and the United States are the largest producers of batteries and they have important agreements with producers of cobalt, lithium, graphite, nickel, manganese and rare earths. China is the largest producer of rare earths. Lithium is found mainly in Chile, Bolivia and Peru and in Congo are the largest deposits of cobalt. Asia is building a dozen “gigafactories” and the United States has Tesla. None in Europe which is very late in battery capacity and should have a “champion” to remain competitive according to Carlos Ghosn, the boss of Renault-Nissan-Mitsubishi. Battery production capabilities will quickly become a major stress for European manufacturers.

Some specialists fear a collapse in sales in 2020-21, when automakers will arrive with more hybrid/ pure electric cars, but with a much higher selling price than those with gasoline engines.

All is not black. Nevertheless, the European and American manufacturers, excluding Tesla, have strong industrial balance sheets with significant net cash positions, including €70 billion for European manufacturers. The German groups will offer a wide range of electric cars from 2020. Volkswagen has a strong market share in China and is expected to electrify all its models worldwide by 2030. The manufacturers have ambitious goals on the electrification of cars, they have the cash for that, but the entire production line of a car, from the manufacturer to the equipment manufacturer, to the tire manufacturer, will be under pressure over the next 5 years.

On the other hand, the rise in interest rates is penalizing for the financial part of auto loans. The cost of a car with private credit / leasing will become higher, and likely slow down sales.

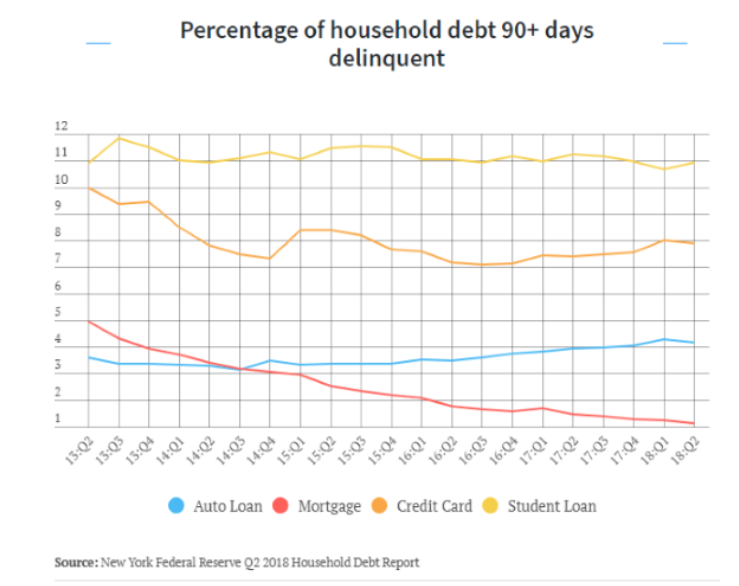

The graph below (source: Federal Bank of New York) shows that the weight of US delinquent car debt in total household debt has increased. Since 2013, US delinquent car debt has risen 77.7% to $ 22.6 billion. Low interest rates have pushed households into debt for cars beyond their financial capabilities. There is therefore a bubble on auto loans and an increase in the deliquency rate could have a negative impact on the entire automotive sector.

- Underweight the automotive sector

- In the short term, trade war and Brexit weigh on the sector

- In the medium to long term, the transition to electrification of the car will weigh on margins

- Global sales may be under pressure in the coming years, as the potential buyer will face more expensive products