Date: 2 May, 2019 - Blog

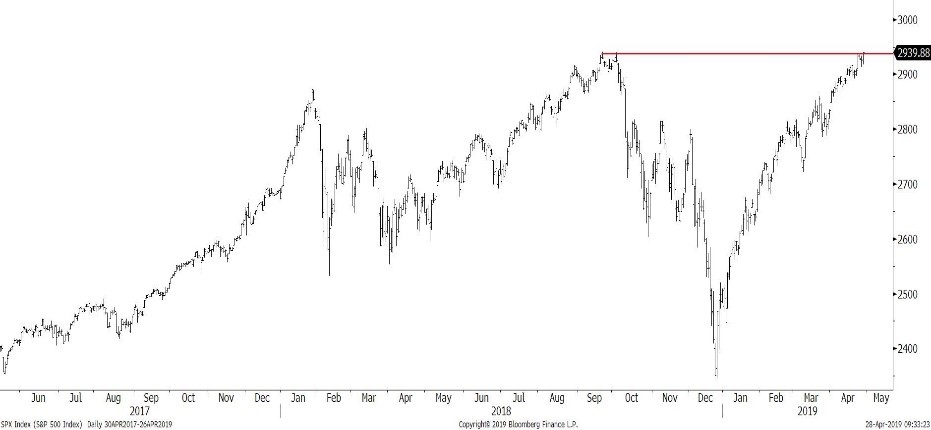

It did it. The S&P 500 broke out its resistance and is entering into new territory; the S&P 500 has closed at 2939.88 last Friday, higher than the previous record at 2936.7 on September 21st, 2018. We will have to confirm this break out in the coming days. The rise in stock markets was without euphoria, and investors rather in risk-off mode. A rather unusual situation.

S&P 500’s breakout

Fears of a recession in 2019 are fading away :

- US GDP growth in 1Q19 was stronger than expected.

- The Chinese economy has stabilized thanks to fiscal and monetary stimulus.

- The decline in US profits will be less marked than estimated in 1Q19. A month ago, Factset anticipated a 4.5% drop in profits, than -3.9% last week and -2.3% today. Revenues are expected to grow by 5.1%. Refinitiv is only waiting for a slight 0.3% decline in profits in 1Q19.

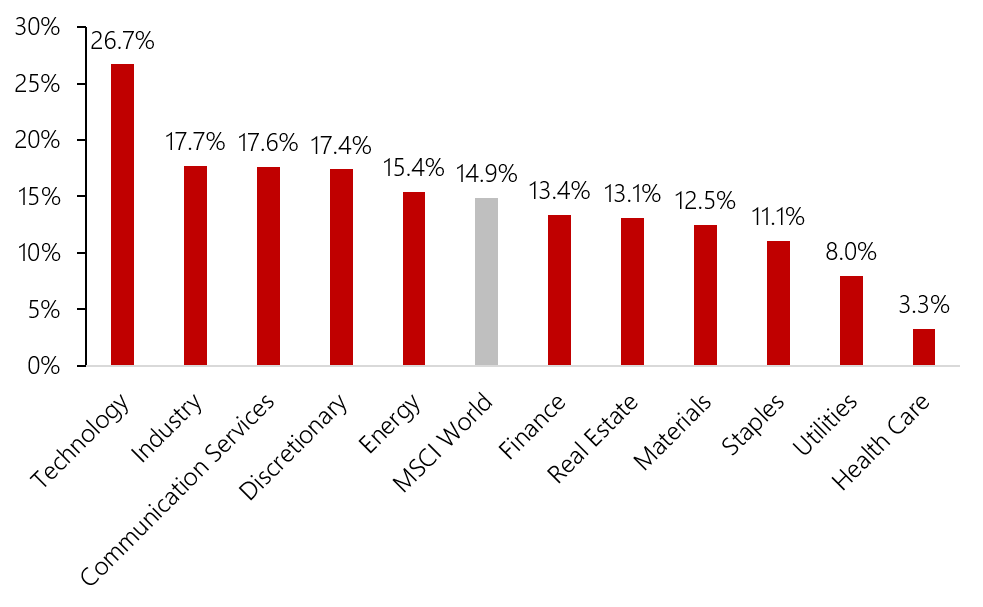

In 2019, the cyclical / value sectors and technology outperformed the defensive sectors.

Sectoral performances in 2019

A trade agreement between the United States and China is approaching, it might precede one with Japan and Europe; this could boost business.

The impact of China’s mega-project Silk Road (One Belt, One Road) should not be underestimated. After clashes with its Asian partners, China had traveled through Europe last month for a seduction operation, to encourage European states to participate economically and financially in this project. We are talking about a $ 1,000 billion.

Silk Road. Land routes in red and yellow, sea route in blue

The reading of the financial markets is complicated with the conflicting messages of risky assets, signaling reflation, and interest rates, implying an economic slowdown. Not to mention the ambiguous intervention of central banks. A trade agreement between the United States and China, as well as the technical breakout of the S&P 500 on the rise, are positive factors.