Date: 9 October, 2020 - Blog

In this time of economic stress, the Fed announced a renewal of restrictions in the fourth quarter dividend payout and share buyback for large banks, those with more than $ 100 billion in assets. One more reason to avoid the banking sector.

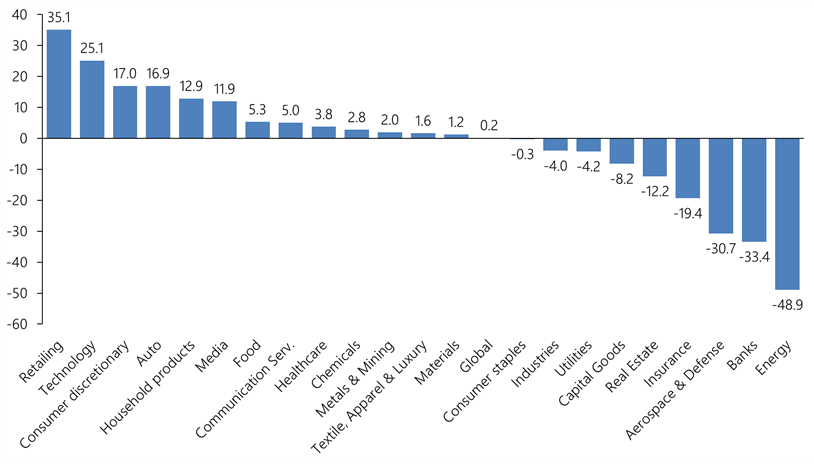

In 2020, the banking sector recorded by far the second worst sector performance.

MSCI World. Sector performance in 2020

Source: Bloomberg, Heravest

The Fed’s fear is strains on loans to households and businesses due to the economic crisis

Currently, the banking problem is on the Profit & Loss account and not on the balance sheet, the reverse of 2008. The Fed’s latest stress test showed that US banks are sufficiently capitalized. Thanks to stronger regulation since 2008, banks entered the pandemic with relatively solid balance sheets. For the top 10 US banks, the equity/total balance sheet ratio was 9.6% at the end of 2019 against 5% in 2007, and at 6% on average for the European sector. The sector has Tier 1 ratios (equity / total risk-adjusted assets) well above the minimum required by the Basel accords of 6%, an average of 17% for European banks and 13% for Americans.

Globally, banks are suffering from low and negative interest rates, declining business volumes and an increase in bad loans. In the long term, traditional banks must integrate the rise of e-brokers, virtual banks and fintech. However, the pandemic is not expected to put banks under pressure thanks to government support to households and businesses, and central bank liquidity which should limit defaults and bankruptcies.

While the US banking sector consolidated during the 2008 financial crisis, European banks have maintained a national, even nationalist, approach, despite the difficulties and the importance of poor quality of loans.

There were also governments tensed up over cross-border mergers and acquisitions and a lack of political will for a European banking union.

Due to the economic crisis and poor profitability, we are witnessing some movements in Europe, but still a national consolidation between the Italians Intesa Sanpaolo and UBI Banca and the Spaniards CaixaBank and Bankia. Crédit Agricole is considering an offer for the Italian Banco BPM. As for the 2 Swiss giants, UBS are assessing a tentative and Credit Suisse, they merger, but the interest is in the global activities of Wealth and Investment Banking, because a merger could not target retail banking in Switzerland, given their already dominant positions.

The default rate should increase in the coming months, hence stock market valuations discount a deteriorated situation. The Price to book value ratio of European banks is 0.5, a 60% discount compared to the average of the last 10 years, compared to a 30% discount for US banks.

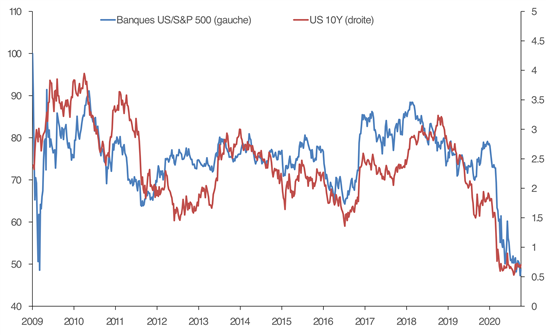

The banking sector is sensitive to the economic situation – volume of commercial business – and to the differential in long and short interest rates – the profitability of interest activities because a bank lends on long-term and refinances itself in the short-term. And to financial markets for those who have a significant portion of their income in investment/commissions. We analyzed the relative performance of the banking sector with the yield curve and with the 10-year rate. The US 10-year is the most correlated with the relative performance of banks. Conclusion: the bank rally will begin with the rise in long interest rates.

Relative performance US banks / S&P 500 and US 10-year rates

In case of a rise in long rates, banks with a more commercial profile should outperform, such as Citigroup, Wells Fargo, Truist Financial, PNC Financial, US Bancorp, HSBC, BNP Paribas, Crédit Agricole, Santander or BBVA.

- Stock market valuations of banks discount a degraded environment

- Unlike 2008, the problem of banks is about income and profits, not about balance sheets

- An improvement in expectations of an economic recovery, with a rise in the US 10-year, would let a powerful rally for banks

- We stay in Neutral, but attentive to any good news