Date: 24 April, 2020 - Blog

Finally, it took a major – external – shock for the Fed to surrender. Covid-19 sped up the ultimate dream of Trump. This pandemic is actually triggering the – inevitable? – merger of US monetary and fiscal policies. Let’s face it: a hyperactive re-liquefaction and nationalizations of broad segments of the capital market are legitimate, in order to avoid a major deflation crisis. Just like in 2008/9. But this is definitely not a durable / sustainable framework.

Right, the ends justify the means

But the Fed loss of independence is not trivial

It’s no longer – just – size that matters… Style counts too

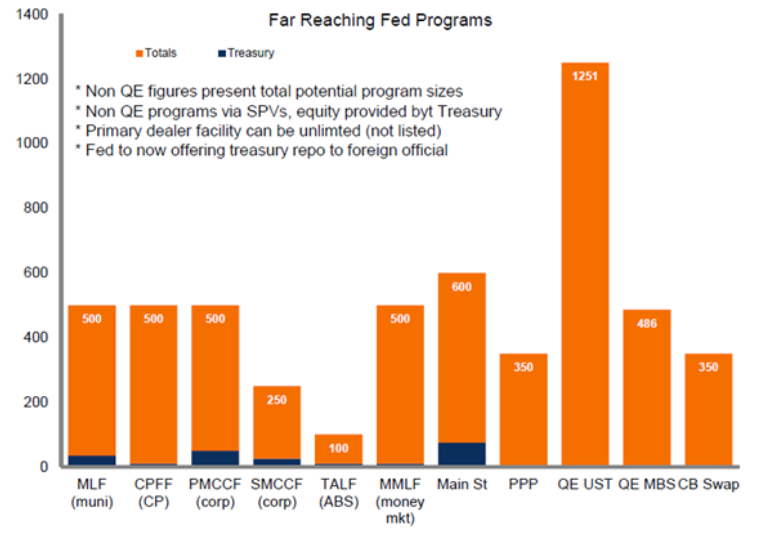

At the peak of QE3 (end 2017/early 2018), the Fed balance sheet was worth $4,5tn. It declined marginally to under $3,8tn in 2019, during an aborted attempt to normalize monetary policy. Fed’s balance sheet could reach $9-10tn by year-end. In short, J. Powell is shamelessly embarking in ̈unlimited ̈ quanto-easing.

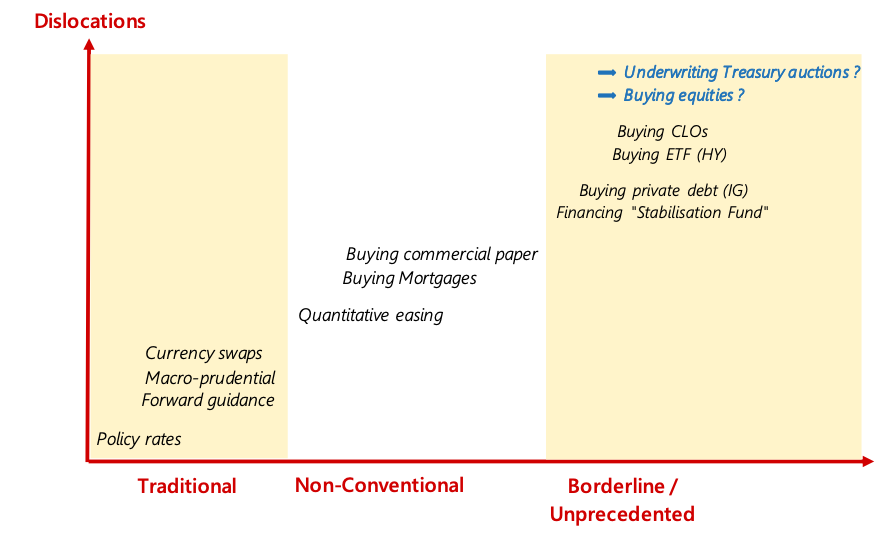

It is just magic now; all barriers are falling. Nothing is inconceivable, when it comes to monetary policy. US central bank is literally obliged to scavenge, in order to bail- out the begging financial markets, on the verge of a major implosion. It passed a Rubicon, when buying private debt of sub-grade quality and leverage structured products (like CLOs). Fed is de-facto venturing into the fiscal area by funding the gigantic $2,2tn fiscal package and by deploying capital into the Treasury’s Stabilization Fund.

Powell is officiously also contemplating to move further, by buying equities (like BoJ and to a different extent SNB). So far, so… ̈good ̈.

Monetary science fiction meets reality

Transferring debt from private to public balance sheets spells moral hazard

This bail-out is just an extension of the (asset price reflation) policy in vogue since a decade

Ultimate dislocations ahead?

The Fed is ̈gaming ̈ the system’s rules, just like the ECB did before. Indeed, Fed’s latest activities have been packaged and delegated (to third private parties) to by- pass formal regulation. This engineering puts the US Congress before the fait accompli.

The ultimate economic anathema, in terms of conventional economics, would be for the Fed to underwrite directly auctions of the Treasury. This would spell pure monetization of budget deficits. This is definitely not in the agenda today. But if the economy failed to rebound by year-end, who would dare to oppose…

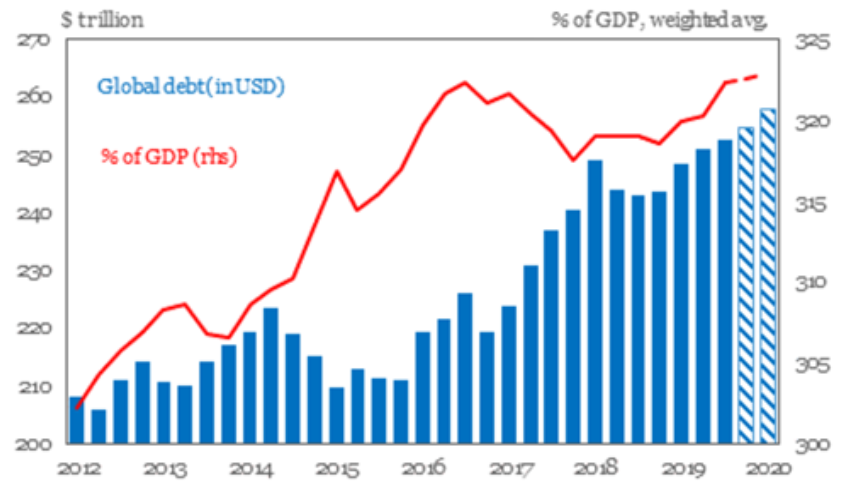

Where next? Global debt reached highs… before Covid crisis

The brutality of the current crisis legitimated the submit of the Fed to US administration… and a shift of US monetary policy’s cursor into borderline territory

- The validity of Fed hyperactivity should not hide the collateral damages / issues

- The relentless progression of global debt is worrisome and untenable long-term

- Broad-base misallocation of capital and markets’ dislocation will continue

- Fed monetization would endanger the world reserve status of the USD and destabilize US Treasury bond market

- Gold remains a hedging asset of choice in this perspective