Date: 8 November, 2018 - Uncategorized

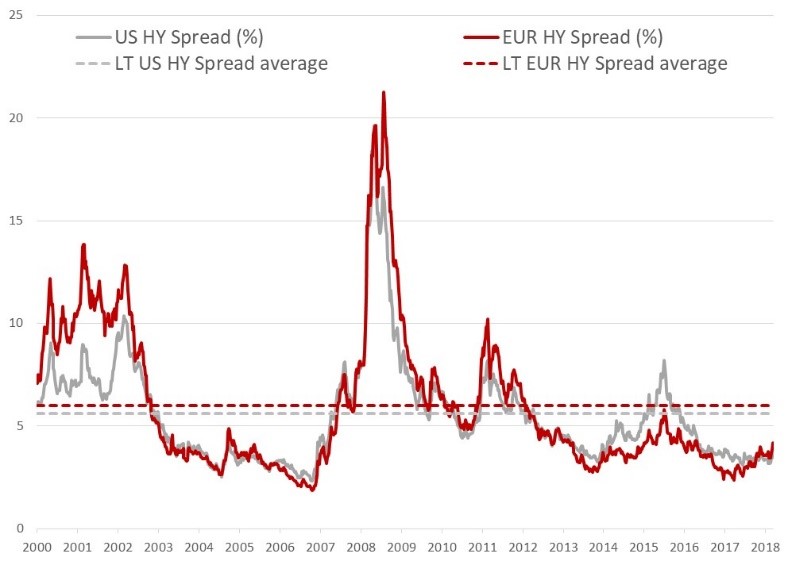

October has been a brutal wake up call for the riskier segment of the fixed income market, the High Yield (HY) debt delivered its worst month in more than 2.5 years. Earlier in the month, the US HY spread reached its lowest level since the financial crisis.

Since then, it has widened to more than 375 bps from 300 bps in less than 4 weeks. Losses were most intense in the riskiest end of the market – CCC-rated bonds and lower – which were the year-to-date best performer up to the equity market correction. The CCC-rated segment reached for the first time since end of 2016 the 10.0% yield to maturity hurdle. The HY repricing has more to do with earnings growth than with corporate defaults fears.

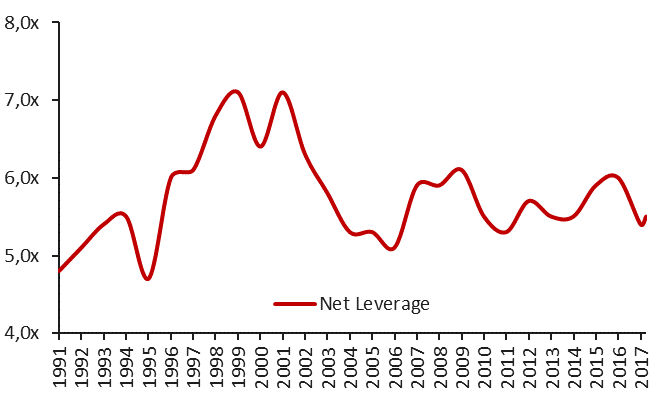

HY leverage is still close to post-crisis low. The usual suspect, when it comes to driving the credit spread dynamic over the time, is the financial leverage. It has been very stable since the mid 2000’s between 5.0 and 6.0 times the EBITDA on a net basis. Much of the improvement in credit quality since 2008 is reflected in the shift in overall quality. As of now BB-rated bonds represent 43% up from 36% in 2008. As a result, the HY market looks relatively stable when evaluated through the lens of leverage and could support the next downturn if balance sheet practices continue, in contrast to other cycles. Even more as the sector split is much more balanced than in the past, the 3 main sectors represent less than 30% of the market, while in early 2016 the energy sector represented on its own more than 20%.

Source: Bloomberg

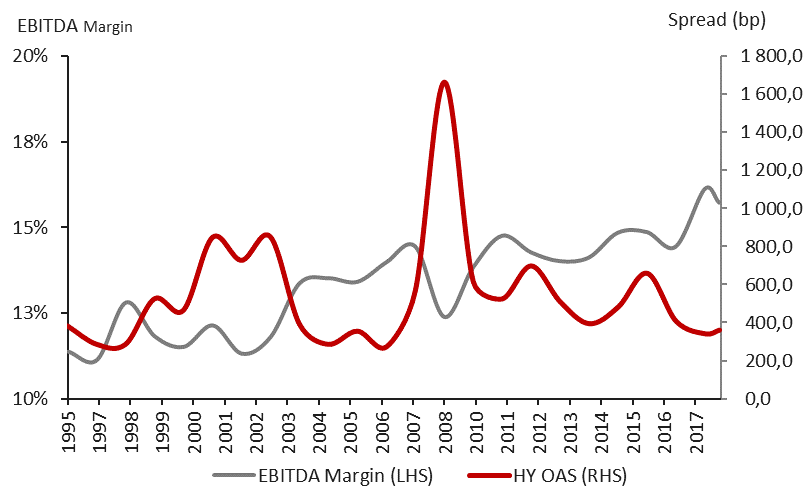

The second most important factor is much more volatile over the time. The EBITDA margin, thanks to the US fiscal reform, has just reached historical high levels. This explains why US HY spreads have reached those tight levels. So far, the fiscal stimulus has supported US earnings and high yield spreads.

The coming slowdown of earnings’ growth is not new and not alarming. This reflects the likelihood that the recent boost to margins from the corporate tax reform will fade. The US HY default rate will remain below 2.0% over the next 12 months, its lowest level since 2013, according to Fitch.

Source: Bloomberg

Even if the HY spreads, in the US and Europe, have widened to their highest level in more than a year they remain still far from their long-term average. A pullback to the average level would provide an attractive entry point.

- A healthy, but insufficient, high yield market correction

- Still too expensive given the risks on corporate margins