Date: 16 January, 2020 - Blog

The ECB is expected to run its first 2020 monetary policy meeting on January 23rd

There is a widespread assumption that the ECB has reached its monetary policy limits, and that the best will be fiscal stimulus. This is not the case. Low/negative interest rates were expected to boost spending through lower mortgage interests, wealth effect and easier funding conditions. But they have mainly reduced savers ’ incomes and bank profitability. Ahead of the ECB strategic review, she still has some tools available. She can use dual interest rates i.e. targeting different interest rates for loans and deposits. Such loans can also be restricted to specific sectors like renewable energies. This would be more effective than QE, forward guidance or NIRP. It would provide a powerful monetary stimulus and could be used to support the Green New Deal.

What will happen if the central bank raises rates on deposits, and cut them on loans? Both savers and borrowers will benefit from it. History shows that such an approach always raise demand. The strongest recent example is China in the 1990s. Interest rates on deposits and loans were set independently. When stimulus was required, rates on loans were reduced by more than on deposits. This is still the case.

For some time now the ECB has acted independently on lending rates

Its targeted longer-term refinancing operation (TLTRO) allows the central bank to lend to commercial banks at negative interest rates, if they extend new loans to the private sector. TLTROs also exclude lending to unproductive parts of the economy like mortgages.

Draghi latest innovation was to introduce tiering system, allowing the ECB to set the rate of interest on the deposits that banks hold with the central bank independently of the main refi rate. The ECB reduced the rate at which banks can fund lending to the economy and raised the average rate that banks receive on their deposits. This is already a partial dual rates policy.

If the ECB wishes to stimulate the economy, it could increase the TLTROs maturity, reduce further interest rate or increase the interest rate on deposits through tiering. Some amendments could be done on the TLTRO, as currently the only requirement to access the program is that banks use it to extend new loans. Lagarde expressed a desire to make ECB policy consistent with the eurozone policy on climate change. So, TLTROs at negative rates should be available to banks that are financing sustainable energy investments. The latest 3-year TLTROs at -0.5% have only a marginal impact on available funding. But a 5 or 10-year loan at -1% or -2% would be a game-changer.

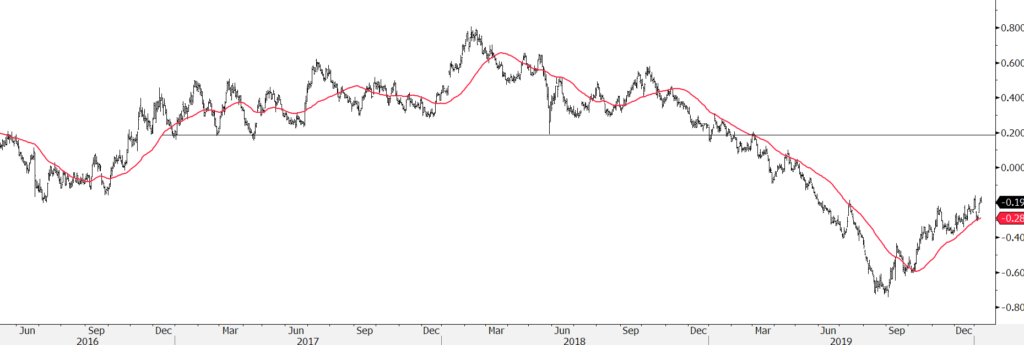

German 10 year yield and its 50-day moving average

Source: Heravest, Bloomberg

- Monetary policy is very far from having run its course. There is scope for a major shift

- Dual interest rates and targeted TLTROs should be at the heart of Lagarde policy

- Upside pressure on 10-year German yields should continue