Date: 2 May, 2022 - Blog

The European Central Bank has been removing stimulus at the slowest possible pace this year. The surge in inflation is now putting pressure on policymakers to act. They are now keen to end their bond purchasing program at the earliest possible moment and to raise key rates as soon as July. The big obstacle so far has been that their longer-term forecasts still showed inflation falling back below the ECB 2.0% target in the next 2 years. Governing Council members have long criticized the ECB for underestimating inflation.

The inflation rate did not continue its rapid ascent of recent months

The spike in fuel, electricity, and gas prices from early March at the start of the war in Ukraine was followed by cautious retreats and governments reducing taxes on energy. This has resulted in a slight moderation of energy inflation. Concerns remain for the months ahead. The recent jump in market gas prices on the back of Russia cutting off Poland and Bulgaria from supply illustrates that it is very possible energy prices spike once again as the war continues.

The impact on core inflation remains key and poses a concern for the ECB. Second-round effects and supply chain problems add to faster price increases in goods and services, which has caused core prices to jump from 2.9% in March to 3.5% in April. With supply chain problems set to last longer and become more severe again due to Chinese lockdowns and the war, core inflation should trend higher for most of the year.

This broadening of high inflation adds pressure to the ECB to act quickly, even though this inflation continues to be rooted in supply-side issues. Things are moving. Fresh estimates – shared by Chief economist Philip Lane on April 14th – showed that inflation will be over target until 2024. The ECB seems keen to battle second-round effects and keep inflation expectations anchored around 2.0%. While the economy remains weak and this is not an environment in which the ECB can hike as much as the Fed, do not expect the ECB to wait much longer. A first hike should come in September, if the economic outlook does not worsen materially from here on. That is a big ‘if’, of course, because the war adds enormous uncertainty to the outlook for the eurozone economy.

Markets are expecting around 85bps of hikes this year, which would put the -0.5% deposit rate back in positive territory for the first time since 2014. A normalization means returning to the neutral rate of interest. It is estimated by the ECB at around 1% to 1.25%. All ECB policymakers stressed, however, that the outlook could change radically until then as Russia’s invasion of Ukraine is a persistent threat to confidence and the COVID-19 pandemic is also not over.

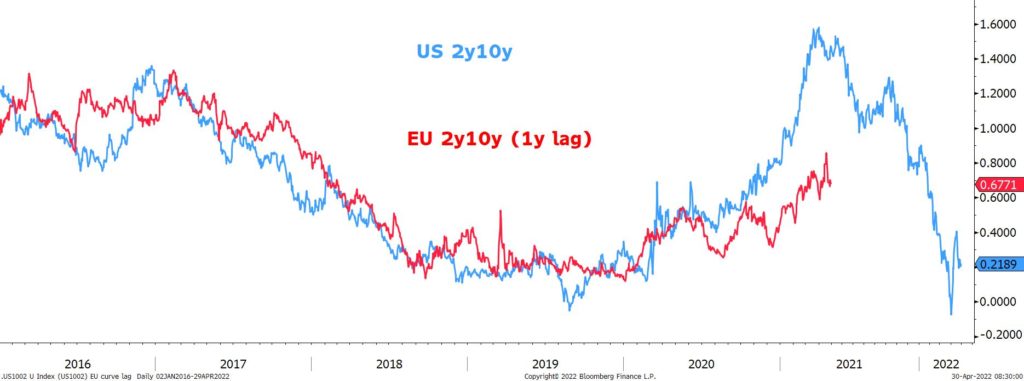

US and European yield curves

Source: Bloomberg

- Pressure is mounting on the ECB to act sooner rather than later

- The European yield curve is lagging the US one by one year. Yield curve will flatten