Date: 23 August, 2018 - Blog

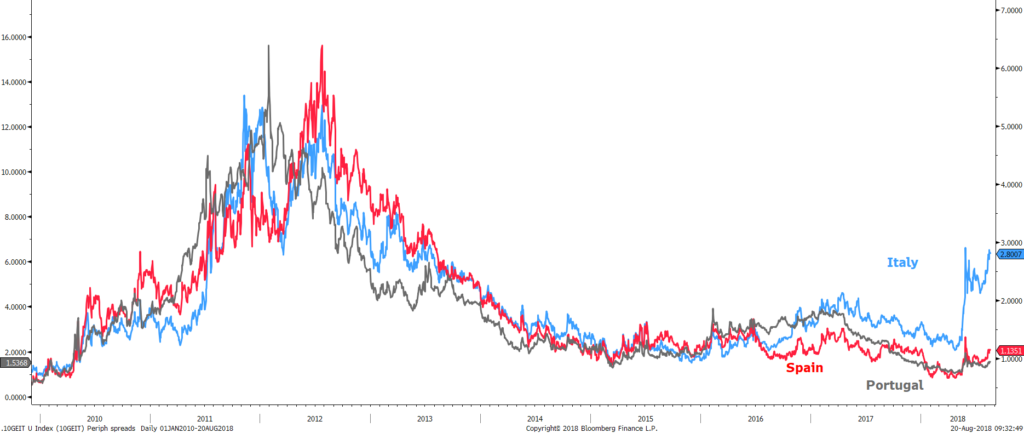

Italian spreads have been volatile since the formation of the current government while other peripheral countries experienced sideway moves. However, recently all spreads have widened with the Turkish financial turmoil. Contagion is somewhat self-fulfilling and follows a circular logic.

The first question is how European government are exposed to Turkey. Based on Q1 2018 BIS data, the foreign banks (on an ‘ultimate risk’ basis) exposure upon Turkey amounted to $223 bn. Based on nationalities, Spanish banks have the largest single exposure, with $81 bn, followed by France ($35 bn), Germany ($20bn) and Italy ($12.5 bn). So, their Turkey claims are equivalent to 2.5% of total bank assets in Spain and less than 0.5% in France and Italy.

They do not look like figures that would undermine the credit-creation process in Spain. Economic confidence and data have shown some deceleration. But growth remains strongly positive at 2.7%, above trend and above the EMU average. This has been clearly reflected in the H1 fiscal results. The government leadership change resulted in significant fiscal policy changes. While it has expressed the intention to raise spending limits and relax deficit limits for regional governments slightly, the lack of anything like a stable majority in Parliament has basically prevented significant changes.

The Italian policy risk remains substantial. Growth has decelerated slightly in line with the rest of the euro area. The problem is that the starting point was not as high as in the rest of the region. Furthermore, Italy faces economic policy risk. Some of the recent labor market reforms have been rolled back and the same could happen on the retirement age front. Fiscal policy statements tend to swing between reassurance of fiscal caution (PM Conte and Finance Minister Tria) and more confrontational demands for flexibility (parties’ leaders Salvini and Di Maio).

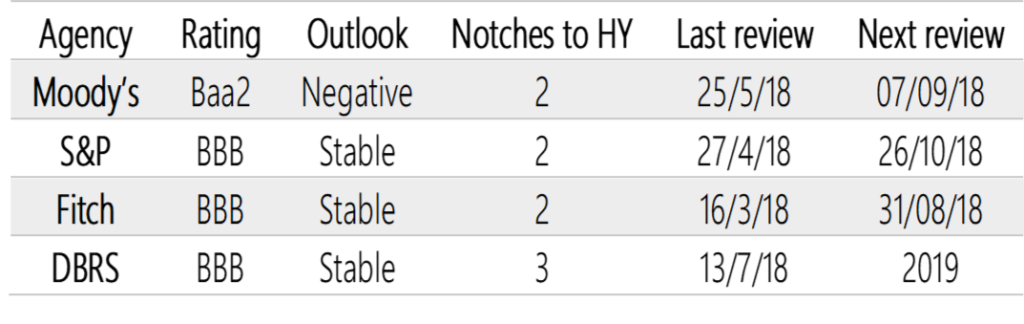

The key element now is more linked to the ECB support and by consequences its rating. Over the coming months, rating agencies will review it. For the time being, only Moody’s has put Italy under review for a possible downgrade. There is a high risk that Fitch and S&P also downgrade their ratings in the upcoming reviews. All three agencies point to the increased credit risk associated with potential fiscal loosening, and this risk may crystallize as the plans in Italy’s budget take shape.

Italian credit ratings

Can downgrades hurt the sentiment? How is the drop to non-investment grade likely? A sub-investment grade scenario could make Italian government bonds ineligible for the ECB QE program. Even if the QE is ending shortly, if Italy had a sub-investment grade rating, the ECB could stop re-investments of Italian public sector securities. In

addition, foreign official institutions have sharply built up their holdings over the last three years. Typically, foreign exchange reserves are held in investment-grade securities and therefore a downgrade to junk could lead them to wind down their holdings. A downgrade would likely impact private sector foreign asset managers and bank investment policy as well. In short, if Italy loses its investment-grade status, it would be a major market event, which would lead to significantly higher spreads. So, the real question is whether a downgrade to junk status would be possible. It looks unlikely in the short term. The current ratings are at least two notches above junk level. Rating agencies move slowly, and a move of more than one notch is very uncommon. In addition, for the ECB, all four rating agencies would need to downgrade Italy to a sub-investment grade rating, as it considers the best one. The buffer to investment-grade provides some short-term protection for the Italian government bond market in terms of the risks related to ratings downgrades.

10 years spreads vs. Germany

Volatility will remain until Italian budget announcement

Our base case remains for an EU-Italy deal solution

- European peripheral bonds look again attractive