Date: 23 May, 2019 - Blog

The recession fears and the absence of a trade agreement have raised the risk aversion. This has led to a global credit spread widening. In such a context, the US corporate indebtedness is worrying again.

The solid economic growth, the low interest rate environment and the banking sector regulatory constraints of the past decade have encouraged corporate to issue more debts than loans.

The US overall corporate debt grew to $5.2trn in 2018 from $2.3trn in 2008, inducing an increase of the non-financial corporate debt leverage to 46% of the GDP now from less than 40% in 2010. The current level already exceeds the previous peak reached in 1990, 2000 and 2008.

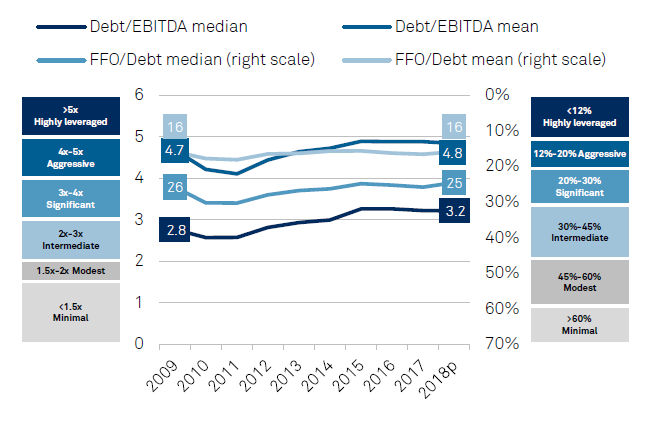

Furthermore, the analogy of the debt to GDP is not that relevant when it comes to the private sector. One should consider business related ratios. According to S&P, a different picture emerges. What is interesting here is that the net debt ratio to Ebitda has remained very stable over the years. Since 2009, higher profits have balanced the total debt increase.

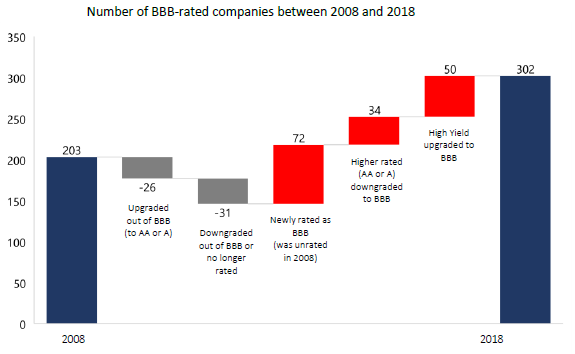

More and more investors are worried about the size of the BBB and BB-rated corporate segments.

Historically, the general increase in a specific segment was the result of large downgrades. According to S&P, the observed increase in BBB and BB-rated companies over the past decade cannot be attributed to this classical process. Most of the growth came from newly rated debts.

The number of US BBB-rated companies grew from 203 in 2008 to 302 in 2018. This increase cannot be attributed to downgrades to BBB. There were only 34 downgrades which have been compensated by the upgrades out of BBB. So, most of this increase comes from the newly rated firms i.e. companies that were not rated 10 years ago or simply did not exist. This suggests that many more companies than ever before have tapped the bond market. The second contributor is the number of companies (50) upgraded from the HY segment. This highlights the global market quality improvement. Those 2 contributors alone represent more than 40% of the number of issuers and by consequences a large part of the BBB segment increase.

Source: Heravest, SNP

The picture and the dynamic have nearly been the same on the BB rated segment. The number of BB-rated companies has doubled over the decade. This is exclusively the result of new companies joining the corporate debt market.

- The recent spread widening represents a window of opportunity

- We favor the European market given that the ECB will extend its support