Date: 21 March, 2019 - Blog

In the first weeks of the year, looser global financial conditions and growing optimism about US-China trade negotiations have supported gains in EM local currency fixed income assets. Slowing global growth, however, represents an increasing challenge to those currencies, where recent performances have been surprisingly lacklustre.

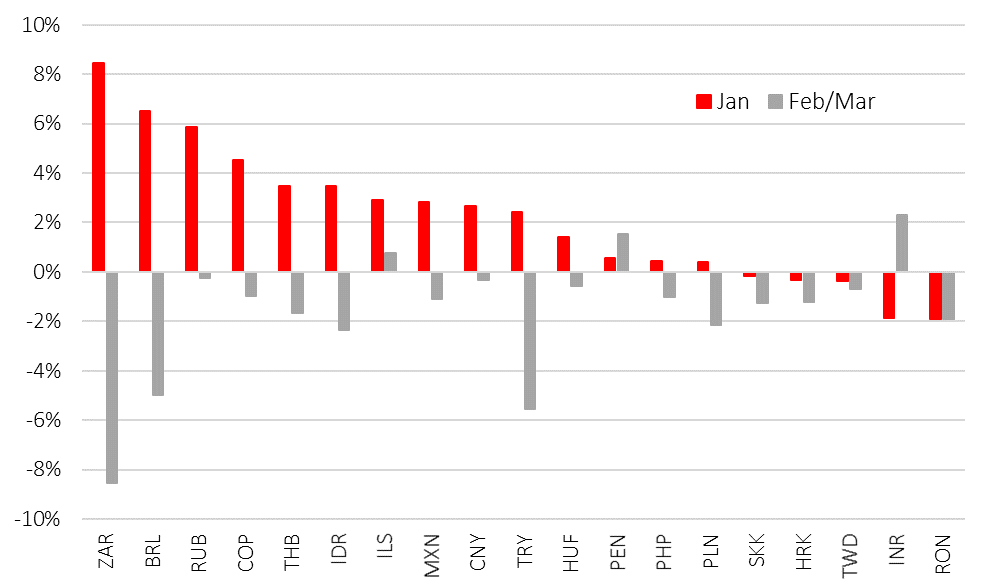

Emerging currencies 2019 performances (%)

Among the high-yielding EM currencies, for example, since early February carry returns have been more than offset by currency weakness in many cases. This may reflect already-long investors positioning or still-subdued EM growth prospects.

Inflows into EM dedicated debt funds were particularly strong in January and February. Despite a general slowdown in emerging economic data, as illustrated by the Economic Surprise Index deterioration, which is back to its 2018 lows, inflows have been significant. China credit indicators have shown some early signs of stabilization, indicating that Chinese growth may be closer to the bottom. But the probability of a strong growth rebound remains low, especially given the reduced official growth target of 6.0-6.5%.

We are about to enter an intensive election period for emerging countries, particularly in Asia. Elections are scheduled in Thailand and Ukraine until month-end, in India and Indonesia in April, and in South-Africa and the Philippines in May. Local elections in Turkey in late-June complete the series. Thailand and Turkey will be under particular scrutiny, with incumbents expected to prevail elsewhere. The risk backdrop has become a tad more challenging in recent weeks with the global central banks dovishness seemingly raising risks rather than opportunities at this stage. However, we continue to argue that EM opportunities still exist. A slow growth, low inflation and extra yield is the most attractive landscape to favor EM bonds. At the exception of Turkey, India and Mexico – which represent together 12% of the Emerging currency local bond market – the other countries are offering higher prima in nominal and real terms than the US and other developed economies.

Furthermore, the correlation with core holding securities like US Treasury bonds is back to its past decade lowest levels, making EM local currency bonds an attractive bond portfolio diversifier.

- Emerging local currency bond extra yield, i.e. valuation, is still attractive

- It remains a good portfolio diversifier