Date: 9 May, 2019 - Blog

Markets’ underlying mechanisms

Traditional finance, based on the hypothesis of efficient markets and statistical optimization, suggests that markets trend has a lot to do with mathematics. But in practice, there is anecdotal evidence that successfully investing requires different expertise / skills too. Indeed, markets are also influenced by human psychology, for instance risk aversion, ¨greed and fear¨, etc.

“Behavioral finance has emerged as a new research field in finance applying psychology to financial decision making and financial markets… it has successfully addressed several observed anomalies concerning investors’ behavior and asset prices”.

University of St-Gallen, 2012

This is a truism; social medias growingly impact on numerous aspects of our life. The genesis of the FoMO concept is based on the social anxiety that results from contemplating the ¨highlights’ feed¨ of other people’s lives on social medias.

For sure these social medias also affect the process of investing. Translated into finance it is nothing more than thinking about the hypothetical returns that one missed (by doing nothing / staying in cash). Arguably, this phenomenon is much more observed in the US (and possibly in China / South Korea), where the culture of (equity) investing is much more advanced and broad-based. Practically, a phenomenon called ¨social stock trading platforms¨ developed last years in the US, like the famous dedicated websites E-Toro, ZuluTrade, Naga-Trader, etc. They encourage anybody to emulate the portfolios of successful stock-pickers, and… to trade!

US retail investors, heavily underweight since the horrible 2009 financial crisis, have finally poured into equity markets with an unprecedented intensity in 2018, just before the two corrections than occurred in Q1 and Q4. After these two painful episodes, they have largely exited equity markets early 2019 and are now desperately observing their recent rebound…

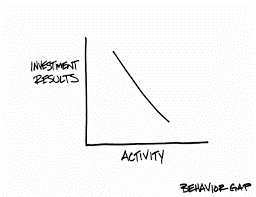

Relation between investors’ activity and performance

US retail investors paid a heavy tribute to the FoMO syndrome in 2018

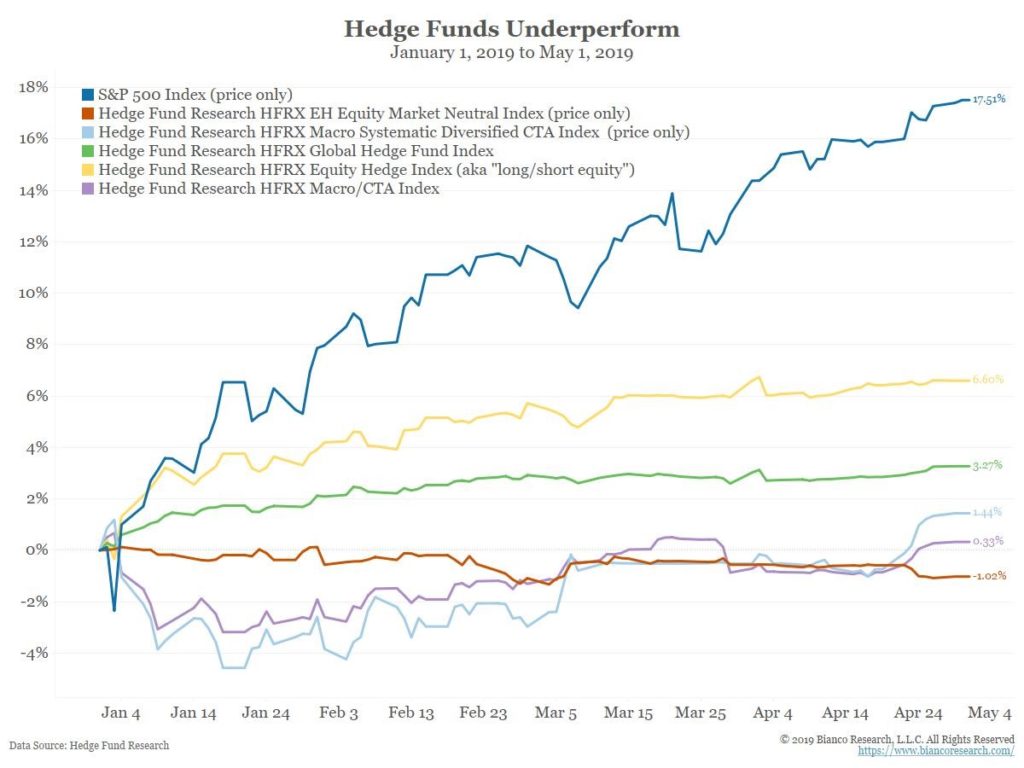

Institutions are not immune

According to latest statistics, many professional investors (pension funds, fund managers, etc.) reduced risks and moved underweight last December / January. They have remained so up to now. Therefore, only a very fringe of nimble professional investors acted and gained from recent assets’ recovery. Among institutions, Hedge Funds also missed the boat and kept their exposure (say beta) well below normal levels.

Underweight Hedge-Funds massively underperformed YTD

When such underperformance lasts for more than one quarter, then comes a different sort of FoMO syndrome, linked to commercial factors and career risk. Indeed, the clients frustrated by underperformance redeem from underperforming funds. Lagging managers suffer pressure from their hierarchy and ultimately risk being fired if it lasts too long.

Preconditions are in place for underweight institutions to re-enter risky assets

Too much of a good thing makes you sick

Growth scare is over. Indeed, US GDP in Q1 was reassuring, China is catching up and very early signs of a bottoming-out of Europe have lately emerged. Therefore, in terms of sectors’ performances, a new theme of ¨reflation¨ is starting to set-in…

China and the US seem on the verge of signing sort of a trade deal. If China – at least on the surface – makes significant concessions, one could even imagine Trump to enter positive talks with Europe and Japan.

Such an improvement of visibility would fuel an additional rally of risky assets

Underweight institutions would have no choice but to re-enter markets massively

- Don’t be complacent in such a scenario, where risky assets melt-up in Q2

- If history is any guide, such sirens’ call should rather be used to reduce risks and take profits