Date: 28 June, 2021 - Blog

¨Inflation¨, this strange animal

Everyone talks about it, each economist gives his or her opinion, historians multiply comparisons. In fact, the very notion of inflation is heterogeneous. Its definition, the very composition of the famous ¨housewife’s basket¨, differs not only according to the countries, but also according to the periods…

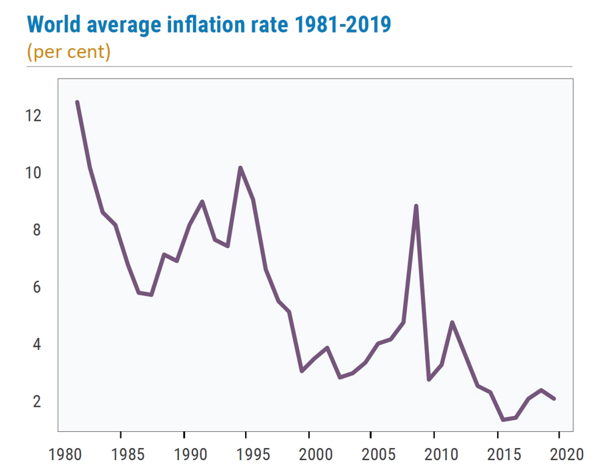

The mega-trend of last decades: secular disinflation

The world experienced 4 decades of profound deceleration of inflation because of three mega-drivers. Demography (aging), Globalization (China entry in the WTO), and Technology (Platform companies & digitalization) put a lid on prices. Interestingly, the last two factors are showing signs of weakening

recently.

Source: UNO

- Firstly, the downward pressure on wages, essentially due to labor arbitrage is losing steam. Wages are rising in China and the Yuan is showing stability, if not firmness. In short, China is no longer the cheapest labor manufacturing country of reference, exporting disinflation though its exports. The pandemic revealed the dependence of rich countries on manufacturing processes that are too concentrated in certain countries (drugs, chips). An inflationary repatriation of certain ¨strategic¨ supply chains has started. In the US, labor also seems politically supported by Biden and may get a fairer share of GDP medium term.

- Secondly, Technology champions are facing antitrust actions from US and European authorities. They are the ultra-rich and convenient political scapegoats. The tug of war between the West and China for chips, microprocessors and all electronic components will raise their operating costs. They are also directly spotted by the latest G7 agreement to raise the minimum corporate tax to 15%. All in all, with a decreasing future profitability, IT giants will either reduce the quality / intensity of services they provide to the public, or, more likely, raise the price of it one way or the other.

Secular disinflation is losing steam

Western democracies tend to tolerate high inflation, while China policymakers hate and fear it

Pandemics is significantly impacting on cyclical inflation

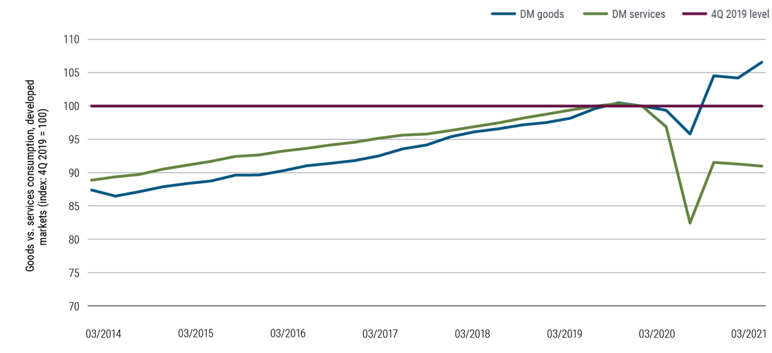

Firstly, consumer goods inflation has far outpaced that of services in developed markets. Anecdotal evidence abounds. As a matter of example PIMCO quotes US sales of exercise bikes that exploded while fitness center memberships plummeted. Similarly, public transportation collapsed, while the demand for autos (including used cars) thrived. This trend could shift-back later in 2021, with consumer shifting back toward their usual services spending.

A temporary – major – shift in consumption pattern

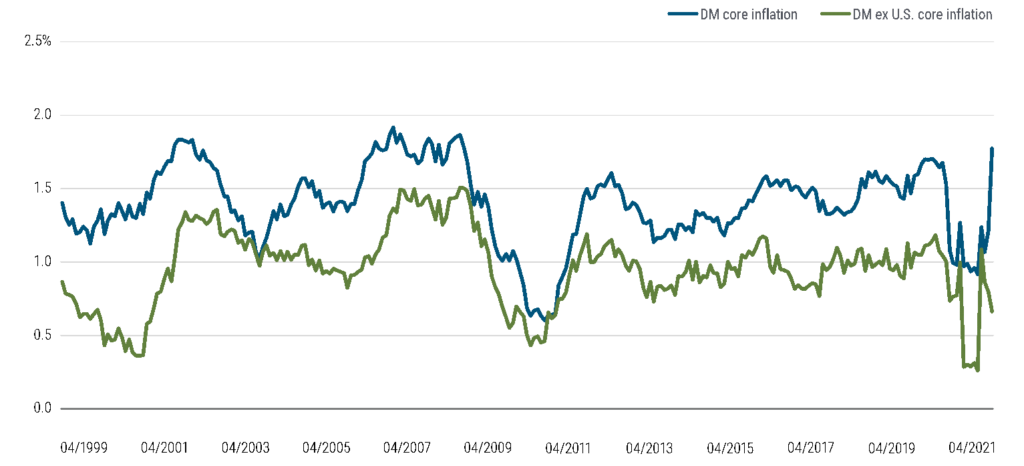

According to PIMCO: “Outside of the US, underlying inflationary pressures in other developed markets have been much more subdued. Indeed, as of April 2021, DM core inflation excluding the US was running around 0.6% y/y versus 3.0% core U.S. inflation. This divergence has occurred despite the global nature of the supply chain bottlenecks, because fiscally stimulated demand for goods in the US has also outpaced other developed markets.”

Source: Haver Analytics, PIMCO

Pandemics has fueled polarization and substitution effects on consumption

For now, inflation is essentially concentrated in the US and goods

But inflation remains elusive and non-homogenous. Beware of too global / simplistic analysis and conclusions about it

- Cyclical inflation will rise and be volatile over next months

- Pandemics may well trigger the end of secular disinflation

- Nevertheless, runaway inflation is not imminent

- Price developments in the US and China, and policy responses, deserve particular attention