Date: 16 May, 2019 - Blog

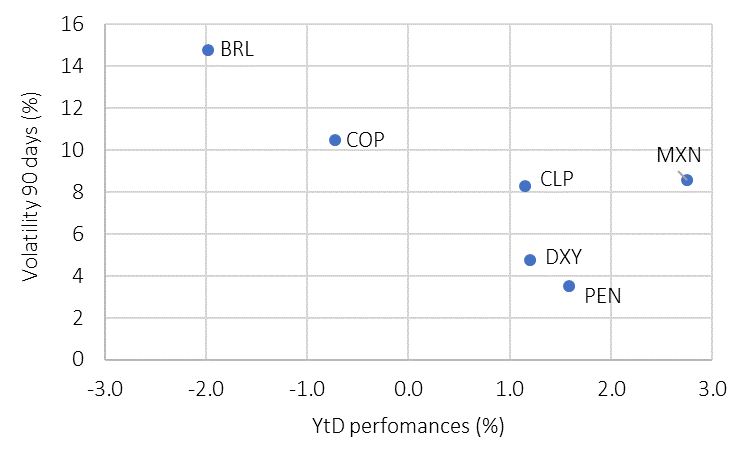

Higher risk aversion and a stronger USD caused recently a persistent LATAM currencies’ weakness.

They have erased all their January gains and are back to their end of last year levels. Some progress on the US-China trade-war impasse could add material upside to emerging currencies. However other risks may continue to hurt EM assets. Apart from a more persistent than expected USD strengthening, some specific issues like higher political risks in Argentina and in Turkey could affect investor sentiment.

Those risks are already well discounted into the currency market. Emerging currencies volatility is trading well higher than the one of developed markets. In a risk friendly environment, emerging currencies have the same volatility as developed ones. In periods of stress, its volatility tends to be in average higher by 2 to 3 points. This is already the case.

The MXN has been the standout outperformer in the region, and amongst EM this year. Even though if the Banxico shift to a dovish stance, the mix of attractive yields and still solid macro fundamentals suggests continued outperformance. The return of a more favorable environment towards EM assets could push the USD/MXN below 18.50 once again.

In the case of Brazil, domestic drivers should continue to dominate, and the BRL has the largest potential appreciation in the region over the coming months.

Foreign investors will continue to focus on the social security reform, which is now in its second-stage Lower House approval process. Approval is expected for next month. Even if all goes wrong, the bill should at least save BRL 600bn. That will give Brazil a significant boost. Furthermore, Brazil plans to reduce import tariffs by 10 percentage points over the next 4 years. The opening of the economy will be exponential. Guedes announced a tariff reduction of around 1% in the first year, 2% in the second, 3% in the third and 4% in the fourth. Annual inflation in Brazil rose to 4.9% in April, its highest in over 2 years and further above the central bank’s end-year target of 4.25%. Policymakers may draw comfort from the fact that it did not hit 5.0% but will react if it remains at this level. All those factors should be BRL supportive.

The CLP has weakened over the past month. This has more to do with the copper selloff in the wake of trade-war worries. However, constructive Chinese data and a favorable resolution to the trade-war impasse could pave the way for a CLP strengthening. The CLP is the currency the most exposed to external drivers.

The COP weakness contrasts with the oil prices rally. The correlation between the two assets has sharply reduced. Domestic drivers are a bit more constructive.

As usual, the PEN has the lowest regional volatility, as it is the least affected by the USD and the risk aversion. The Q1 economic slowdown and the potential central bank FX intervention would likely limit any sustained rally.

- Latin America currencies look attractive

- We favor the most liquid i.e. the BRL and the MXN