Date: 27 November, 2020 - Blog

Even if Mnuchin has cancelled the key lending facilities, Powell says it is too soon to put away its emergency tools to help markets and the economy. Powell looked set to extend that were due to expire at year-end. The Fed response is that the full suite of special facilities continues to play an important role as a backstop for a still strained and vulnerable economy. It is still unclear when or how the reclaimed funds might be redeployed.

It is fair to say that the market does not need help right now, but the real economy still needs it. The US is heading into a tough winter, with infection rates setting daily records, renewed restrictions on activity, school shutdowns and more businesses closing.

Treasuries, unsurprisingly, rallied on the administration’s message, sending the US 10-year bond yield back toward 0.80%. The politicization of market stabilization policy will force the Fed to more action at its December 16-17 meeting. That probably means laying out a more-detailed bond-buying plan, the QE is a very imperfect substitute for a credit market backstop.

The credit facilities have their detractors. The run-up in asset prices since the primary- and secondary-market purchases were announced made even some investors queasy. And this month, yields on lower-quality corporate bonds sank to record lows, a worrying sign for those warning of a zombie-company apocalypse. There is just no substitute for government action – a point Powell himself emphasized many times to lawmakers in his testimonies alongside the Treasury Secretary.

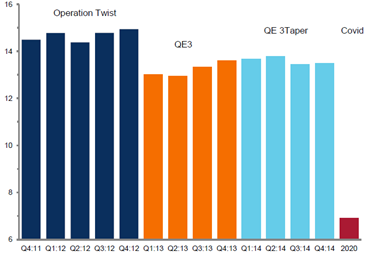

Fed purchases weighted average maturity

Source: Fed

- The Fed has still room of maneuver under its current framework

- The main Fed demand is a government support