Date: 23 April, 2020 - Blog

For the currency market, the Covid-19 crisis has evolved in several phases: denial, repricing, capitulation, and stabilization. Investors firstly focused on the fall-out in China and trade consequences, which fueled an EUR weakness (Jan/Feb). Secondly the Fed repricing led to a USD sell-off (Feb/Mar). Thirdly, the risk capitulation led to a fly to quality and liquidity pushing up the USD (mid-Mar) and finally stabilization leading to the USD giving up some of its gains (Mar/Apr). Capital flows – notably portfolio rebalancing – and rising spreads (Libor, euro periphery, corporate) and a looming oil price war have dominated FX markets. In an uncertain context, valuations are not the main market driver, technical factors are much more important.

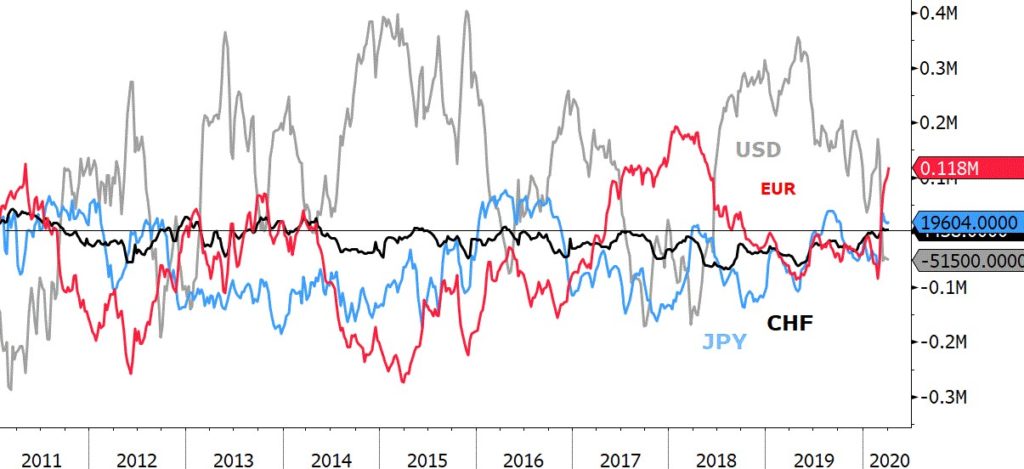

Speculative positioning does not display clear evidences of a shift towards pro-cyclical currencies. Investors have increased bets on the defensive low yielders (JPY, CHF and EUR). They are still trimming their commodity related and EM currencies bets. The USD and GBP positioning remains neutral.

Some market dislocations are appearing

While the net positioning in low-yielding currencies JPY, CHF, EUR rose in the recent weeks, these 3 currencies have underperformed. This is even more surprising given that the risk appetite started to recover. Building net long positions in defensive currencies tends to indicate that speculative investors have not yet made the shift to a more risk-on approach.

Developed markets speculative positioning

Source: Bloomberg

Source: Bloomberg

The EUR positioning is back to early 2018 highest level and shows no sign of rising concerns about possible turmoil in the European debt market, and even if EU governments failed to adopt a common response to Covid-19. The JPY and CHF remain the only 2 other developed currencies with a net long positioning.

While the resilience of low-yielders positioning denotes a continued defensive approach, this is not moving in tandem with building a USD long stance, which has been the key safe-haven currency and asset over the past few weeks. The USD speculative exposure has not followed the large USD swings seen throughout the recent market turmoil. The USD positioning recently turned negative for the first time since mid-2018. The GBP is also back to a neutral stance after seeing most of its net long positions being curtailed as the pandemic started to hit the UK.

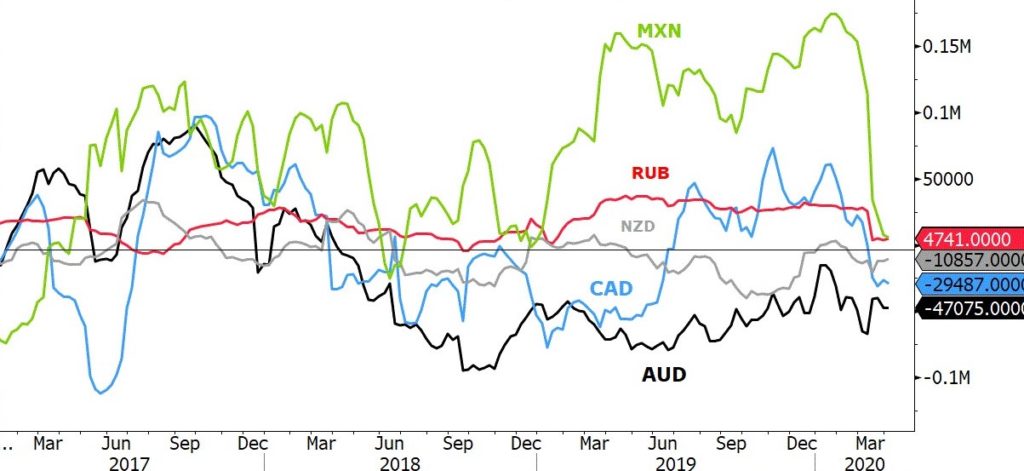

In the rest of the developed world, the dollar-bloc continues to show some divergences. The AUD remains the biggest G10 short, as it has been for the past 2 years. Investors just adopted net short positioning on the NZD and CAD in recent weeks.

Commodity related currencies speculative positioning

Source: Bloomberg

The EUR/USD seems locked in its recent range, but with a bias towards a small downside still as we doubt optimism will be able to form around EUR for now. While the cyclical currencies have taken back roughly half of the losses from the corona sell-off, a full recovery is not in store. Commodity prices are set to linger at current levels for an extended period as we see rather limited upside in oil prices despite oil producers cutting back.

- Unlike equities and some segments of credit, currency positioning is still in risk-off mode

- FX markets are in a state of consolidation, awaiting clarity regarding the economic and financial fall-out