Date: 14 September, 2018 - Blog

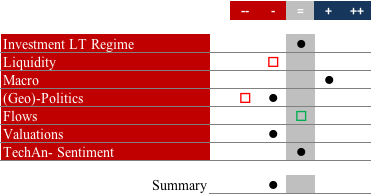

Investment Conclusion: Unchanged allocation as light remains orange…

Regime shifts underway

- No decisive shift (yet) in bonds to equities correlation, but…

- USD liquidity under strains

- Benign macro environment. China economy is key for global growth prospects

- Geopolitics are corrosive. Watch for a particularly challenging US H2 political agenda

- USD Cash remains a valid – hedging – solution

- A severe solvency crisis in Emerging Markets is unlikely

Cross-asset analysis. Ambivalent developments underway…

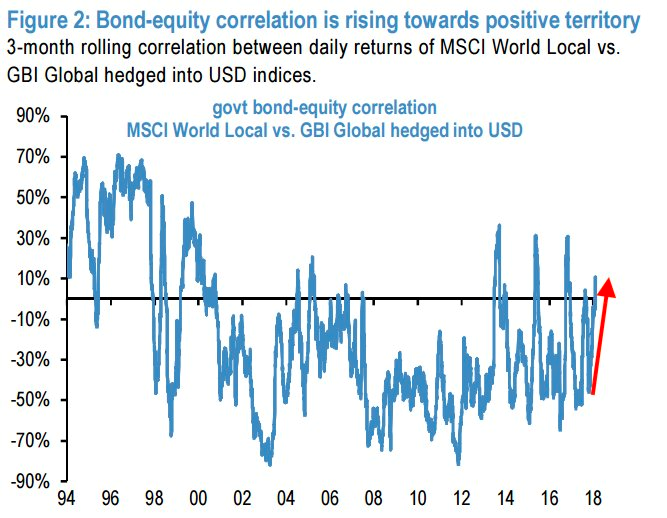

Over the long run, correlation of equity and bond returns has been either positive or negative for prolonged periods of time. The stance of monetary policy is a key factor: restrictive monetary policy spells positive correlation. By contrast, accommodative monetary policy fuels negative correlation, just like the prevailing regime since the late 90’s. International markets shifted from permanently positive (and often large) stock-bond correlations around 1998-1999…

In short, this cross-asset correlation tends to be lower, if not negative, in low inflation (disinflationary) regimes. US markets are sniffing a change of regime. This seems actually logical, based on the gradual normalization of monetary policy and on the latest resurgence of cyclical inflation. A definite shift into positive correlation would spell a sustained acceleration in inflation, coupled with a restrictive monetary policy. We have not reached this stage yet, but the odds are gradually rising…

A shift of regime would be of major consequences in terms of everybody’s portfolio construction. Such a scenario would impact huge sums of money, which are positioned for a continuation of a negative correlation (risk parity strategies).

It all comes down to the US economy: towards overheating over next two years, or ahead of a recession in 2019?

Bond to equity correlation: tentative shift from negative territory

Source: JP Morgan