Date: 23 January, 2020 - Blog

It is remarkable how the CHF has strengthened since the December SNB meeting despite fading political risks. One interpretation is that markets are expecting a prolonged period of low inflation without adding to expectations that SNB could cut rate further. The SNB kept its monetary policy unchanged in December at -0.75% and will maintain it in March. It reiterated that the CHF is highly valued and that it is ready to intervene in the market to weaken it, if needed. On a PPP basis, it is only overvalued by 7% which is not that extreme. However, a stronger currency is not welcome as it slashes all its efforts to push inflation higher. With inflation forecasted at 0.1% in 2020, far from the target and able to fall below 0% in an adverse scenario, the SNB can only maintain rates in negative territory and fight against a strong CHF on the FX market.

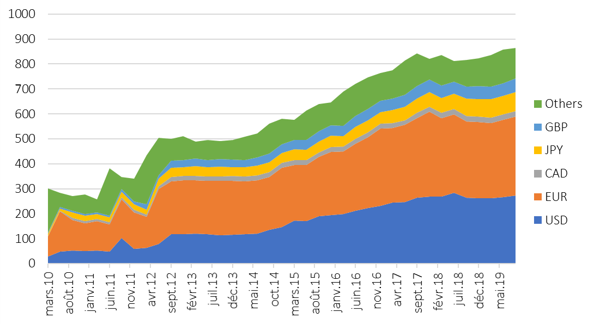

SNB balance sheet (CHF bn)

Source: SNB, Bloomberg

With a 3-month delay, the US Treasury FX Report has been released

As expected, China’s manipulator label was lifted, and the attention shift to other countries. Switzerland is an interesting one. Meeting both the bilateral trade and current account criteria, currency interventions by the SNB – more likely, after the recent CHF rally – may warrant the manipulator label. However, some clarifications are needed. First, the FX purchases currently amount to $3 bn, or 0.5% of GDP. So, meeting the 2% threshold would imply a considerable $12 bn of net purchases in a year. Second, the Treasury requires that net purchases occur for at least 6 of the 12 months covered in the report. So, a one-off intervention may not imply further buying. Third, a possible manipulator label would not happen until October 2020, when the next report will be released.

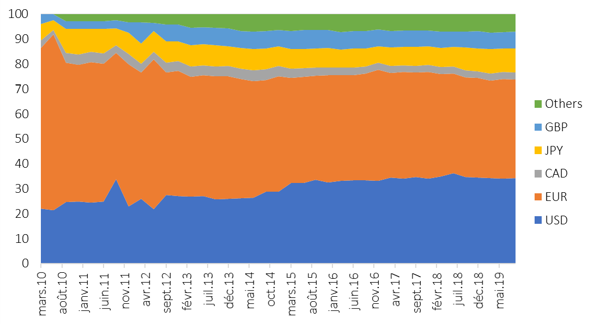

SNB balance sheet currency allocation (%)

Source: SNB, Bloomberg

If the Swiss economy is hit by a negative shock or if the CHF appreciates too much, the SNB could be forced to lower its key interest rate even lower, possibly to -1.0%. This is not our base scenario, but the risk of a fall in interest rates remains very present.

The SNB could consider restructuring its balance sheet, out of USD assets into EUR ones, to downplay the US tensions and support the EUR. For the time being, the SNB holds 34% of USD-denominated assets and 40% in EUR. According to the Confederation, in 2018, Switzerland exported 46% to Europe and 16% to the US, while it imported only 64% from Europe and only 8% from the US. Even it was a smart decision to favor US assets – given their excess return – the currency reserve allocation significantly deviates from the trading partners split.

- Risks of a stronger CHF are rising

- SNB might be forced to reconsider / amend its currency allocation