Date: 12 September, 2019 - Blog

Moral Hazard variations

Moral hazard exists when a party to a transaction has an incentive to take unusual business risks, because he is unlikely to suffer potential consequences.

Source: Investopedia

In the late 2000s, the recession brought to the light the risky behaviors of US giant corporations like Bear Stearns, AIG, Chrysler and General Motors. Their inept strategies, excess leverage and accounting ¨tricks¨ eventually put at risks the $ billions of contributions to the economy, as well as thousands of jobs. US taxpayers money was injected to save these firms, considered as too big to fail. Top executives of these firms have actually been shouldered by public money.

In Europe, the cult of austerity and the Maastricht treaty leave, in principle, no place for Moral Hazard. In practice, Greece bailout and the multiple financial engineering activities of the ECB have allowed for a confidential / officious version of it. Italian and Spanish banks have been practically given life support over last years via – sometimes indirect – public funding. German banks, if not car manufacturers will eventually come next.

UK / Ireland also intervened to bail out major banks.

A couple of decades before, Japan did it too with life insurers, which risked bankruptcy because of too generous fixed income liabilities payable to policyholders. The government just broke the private contracts and their changed conditions…

The Moral Hazard is also at the heart of China’s banking system

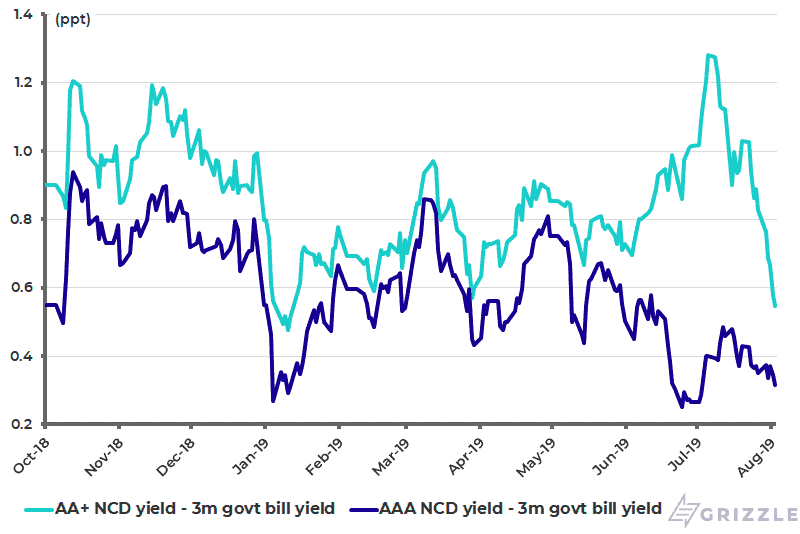

Policymakers hate to bail out banks, but have been doing it for years. Bank of Jinzhou, a small northern lender, is one of the latest example of such an operation last August. Before that, the money market panicked last June, when Baoshang Bank (Ineer Mongolia) was taken over by authorities, but without all its liabilities being covered. Indeed, while all household depositors were fully guaranteed, corporate depositors and interbank creditors with over Rmb50 million (US$7.2 million) exposure were only paid out up to 70-90%… This laudable attempt to impose discipline in the banking system could easily have triggered mass panic in what was the first bank takeover by the authorities since the early 2000s. Ultimately, the bank achieved to close short-term refinancing, through negotiable certificates of deposits (NCDs). The domestic credit market calmed rapidly.

NCD yield spread over 3-month government bill yield

Source: Grizzle

The Baoshang takeover confirms the government’s will to advance in its long structural reform process, i.e. in the fight against moral hazard. This is surprising (courageous?) in the context of last year‘s painful deleveraging squeeze on shadow banking. Relevant authorities seem indeed committed to reducing risk in the financial sector, whatever the price / cost.

- High-level political support for structural reforms continues in spite of growth deceleration

- China is playing a symbolic redux of ¨the long March¨ (military retreat undertaken by the Red Army in October 1934 – 1935)

- We should neither expect a major fiscal easing (à la 2016), nor quantitative easing in the short-term. Economy and markets will probably muddle through

- But it may emerge in H1 2020, just when the US economy and President will face critical deadlines