Date: 4 April, 2022 - Blog

The surprisingly unanimous decisions taken by European leaders about the Ukrainian support and Russian sanctions have rekindled the idea of a more integrated Europe. The European Union is reportedly considering joint bonds in support of higher defense and energy spending. It would cement the process of EU economic integration that was already accelerated during the pandemic with the launch of the first joined bonds.

The NextGenerationEU (NGEU) plan offers a unique chance. This mechanism has a low-risk profile because it is backed by the EU budget. The maximum funding the Commission can request from Member States has been raised by 0.6% of gross national income (GNI). This temporary increase will apply until the last NGEU bond matured in 2058. It comes on top of its permanent own resources ceiling of 1.4% of GNI. The Commission also plans to introduce new resources like a contribution based on non-recycled plastic waste, a share of revenues from the emissions trading system, the carbon border adjustment mechanism, and a digital tax.

A safe and liquid pan-European benchmark is the next step

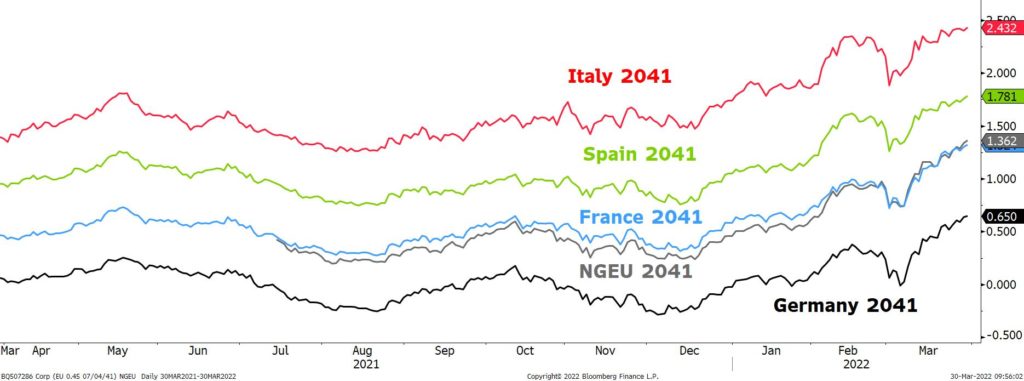

European sovereign bond yields

Source: Bloomberg

NGEU bonds are a cornerstone of European common policy

The current EUR government bonds benchmarks are Germany and France. Both have strong credit ratings and a highly liquid curve. However, they are vulnerable to idiosyncratic shocks.

The NGEU issuer is still recent and has only issued €71bn of bonds in 2021. Things will change. The EU must issue €800bn by 2026 to finance it, making it one of the largest public debt issuers in the euro area.

The NGEU funding plan differs from other euro sovereign programs as it includes a high proportion of green bonds. The EU aims to raise them up to 30% (€240bn) to become the largest green bond issuer in the world. The 1st NGEU green bond issuance in October 2021 hit a record issued amount of €14bn and orders of €135bn. A green safe liquid European asset would help to satisfy investors’ decarbonized demand while only 1.3% of euro sovereign bonds are green.

There is a strong investor appetite for this type of asset, due to the tightening of prudential regulations

NGEU bonds can be attractive to diversify risk-free portfolios

Still a long way to go

To be attractive, NGEU debt should offer good liquidity to allow trading in the secondary market with limited price variation. The European Commission strategy is to develop a full curve by using main sovereign issuers methods like a regular issuance calendar, by auctions and syndications, and through primary dealers. It will use a broad range of maturities from 3 to 30 years. Furthermore the development of a repo market should increase liquidity and the development of a futures market could make NGEU bonds a new reference.

- With a AAA rating & a green label, NGEU debt have everything to be successful

- A market success is a pre-condition for debt mutualization