Date: 26 July, 2021 - Blog

Usually, it takes the central banks to ¨remove the punchball¨, or a recession, to seriously derail financial markets. At first, none of these scenarios are in sight, fortunately. But the stunning macro noise and the growingly delicate passiveness / procrastination of the central banks are creating sort of a malaise. Divergences among Fed committee members add to uncertainty.

Since the onset of the pandemic, most risky assets have first acknowledged, in a globally convergent way for the reflation and then, for a phase of expansion. But for a few weeks, we have been observing interesting developments below the surface.

Pandemic spells long lasting macro-volatility

US latest inflation data have proved – again – very solid and above consensus expectations. Experts who deconstruct price increase figures, even the most disinflationary, observe with some amazement the acceleration of the process. At best, for the most optimistic, the price slippage will be strong and will last for several more months. At worst, for the most alarmist, the widening of the number of factors driving prices up, pending the contribution of rents (OER) which is looming in the short term, confirms the beginning of a cycle of runaway inflation. This ¨macro-economic noise¨, which was expected, is no less disturbing to observers. To be honest, a whole generation of young economists and portfolio managers have not experienced inflation at all, lulled as they were by the great disinflation of the last 20 years. Their amazement and doubts are more legitimate.

Macro-data noise has just started

Rising inflation is a new paradigm for numerous investors

Growing divergences below the surface

If one looks at Wall Street and some other equity markets, all is well, there is nothing to report. Granted sector rotations are quick and participation – leadership – is getting unusually narrow. But still, large indices are flirting with all times high level. Equity investors are opting for the Fed story, whereby inflation rise is transitory, hence ultimately benign.

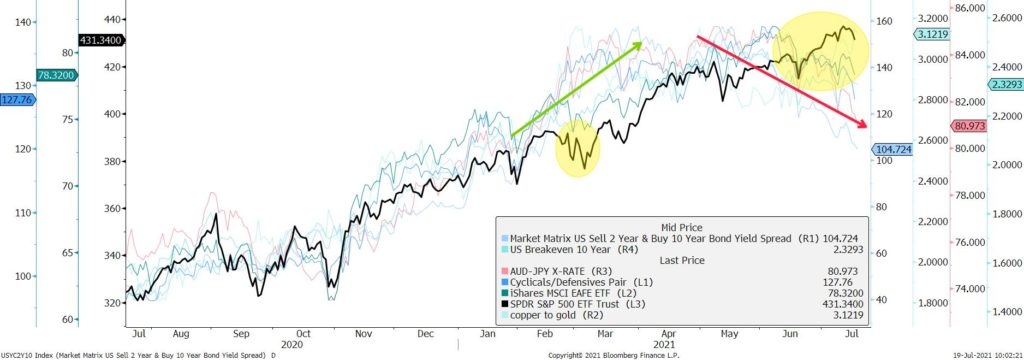

Yet, this is clearly not the case for several other asset classes or some more ¨technical¨ indicators. Thus, among the fine indicators related to the bond market, a) the slope of the yield curve (differential between 10-year and 2-year bonds) is flattening continuously and b) the inflation break-even points (10-year bond) keeps going down.

Numerous assets, ex-US equities, have engaged in a risk-off period

Source: Bloomberg

Similarly, the AUD/JPY exchange rate, the ratio of cyclical to defensive stocks, the relative performance of emerging markets and the ratio of copper to gold have all been bearish for several weeks. See Graph above.

Also, some highly speculative assets, such as SPACS, US lumber, crypto-currencies and the famous ¨meme stocks¨ that fascinated retail investors, are taking a serious nose dive.

On the macro front, US employment data have disappointed lately. But the end of government largesse (checks) and the re-opening of schools in September should trigger a) a larger participation – a wider come-back – to the employment market and b) lower tensions on wages. This may support better 2022 consumption, hence growth forecasts.

Do not be too reassured by Wall Street serenity, as it contrasts with the feverishness of most other risky assets

Macro Noise will continue short-term and favorable. Better signals are not expected before late Q3

- Risky assets should remain in a consolidation / risk-off phase short-term

- The persistence of financial repression and negative real interest rates offer a shelter against more negative markets’ developments