Date: 6 March, 2020 - Blog

Kraft Heinz is one of the largest US issuers downgraded into the high yield segment

The company has $30bn of debt. Its downgrade into the high yield territory was more due to company-specific reasons than systemic risk. The volume of US low-rated investment-grade corporate debt has significantly increased since 2007.

BBB- rated bonds represented c. 15% or $590bn of the $4 trillion investment-grade bond universe in 2019. In comparison, in 2007 it represented 13% or $170bn of the universe. The amount of low investment-grade US bonds outstanding increased by 245% over the past decade.

Kraft Heinz’s downgrade illustrates how limited cushion in credit metrics and the inability/unwillingness to preserve credit quality can increase the risks of downgrade. The downgrade reflected that its leverage is likely to remain above 4.0x for a prolonged period due to ongoing EBITDA challenges and limited debt reduction potential. This is due to its decision to maintain an annual dividend and uncertain timing around asset sales.

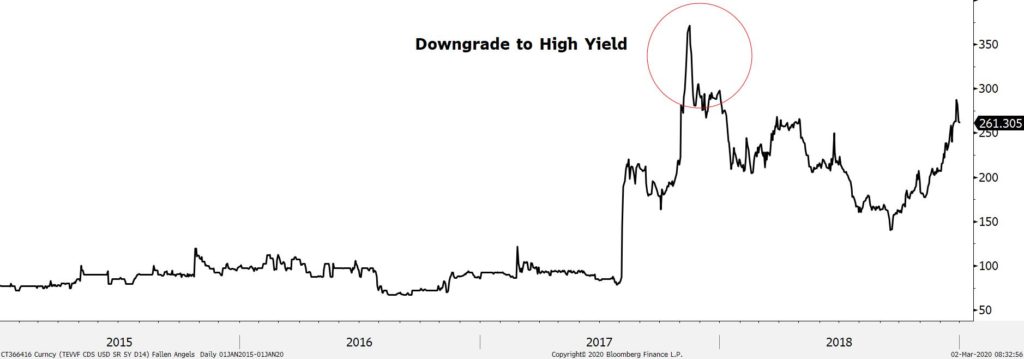

Teva 5-year CDS spread

Source: Bloomberg

In the past, once the market has digested those large downgrades, bonds have recovered. Teva was another large downgrade in 2017, as it was facing significant operational stress when it needed to reduce debt from the acquisition of Actavis. General Motors and Ford were both downgraded to BB+ in 2005, both had more than $20bn of debt, excluding their financial services operations. Both companies have since then been upgraded back to investment grade. Telecom Italia is another interesting example. Even when Italy experienced challenging time, with large international defiance regarding its indebtedness sustainability, Telecom Italia spreads after a large widening in the wave of its downgrade have strongly recovered.

- Kraft Heinz, like Fallen Angels in general, is attractive