Date: 15 July, 2021 - Blog

Sometimes it does not take much for economic forecasters and markets’ mood, which are fickle by nature, to turn around. Actually, the past 5 quarters have featured unprecedented changes in investors’ perception of changing macro perspectives.

A very fluid post-pandemic landscape

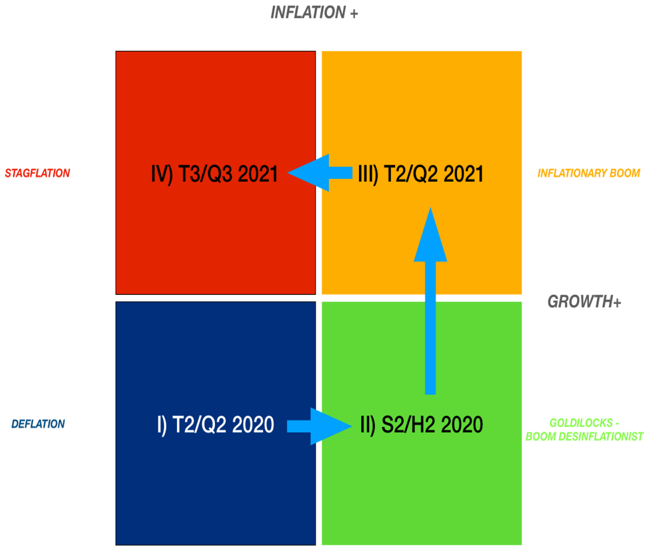

Financial markets first feared risks of deflation when the pandemic spread out. Then, policymakers’ hyperactive measures created a better feeling of reflation / recovery boom. This quickly gave way to perspectives of an inflationary resurgence. A scenario installed for a few quarters, featuring the reopening of most major developed economies and transitory inflation, boding well for literally extraordinary GDP growth figures, probably through to the end of 2021. Global economic vulnerability was considered decreasing, as immunization progresses.

The big macro carousel

Yet the mood and outlook have darkened, abruptly, in recent weeks. Interest rates are falling back down and safe-haven assets rebounded. After having feared runaway inflation, markets are now afraid of a growth hiccup. The S word – Stagflation – resurfaces. It is reminiscent of poor economic periods, namely in the 70’s.

Are stagflation fears realistic?

A framework where, in 2022, inflation would remain sticky – say over 3% – coupled to a significant growth deceleration – say close to 2% potential in the US – would no doubt be disappointing at the starting point of a new business cycle. An additional serious growth relapse would indeed be unwelcomed in the context of the huge debt pile accumulated during the pandemic. Such an adverse scenario, now loudly presented by renowned doom economists – like D. Rosenberg or N. Roubini – is not impossible but have low odds (<20% probability) in our opinion. Actually, it would take a sequence of several negative events to unfold: a policy error by central banks, a return to fiscal austerity, the end of wealth effect – i.e. severe corrections of real estate / financial markets – etc.

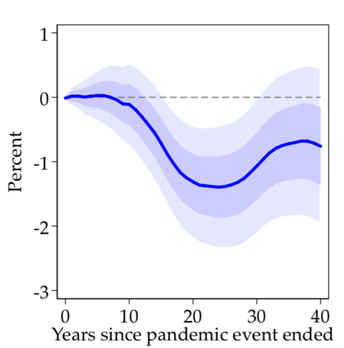

According to the recent comprehensive study (Feb 2021) of the San Francisco Fed, covering 19 pandemic events since 1331, the level of natural – equilibrium – rate of interest rates fall in the aftermaths of the sanitary crisis. This is namely due to a durable rise of consumers’ propensity to save, because of the scars of the sanitary crisis. In short, the economic situation remains sluggish for a long time, due to the persistence of a feeling of insecurity among households and businesses.

Impact on natural interest rate level

This may well be what bond markets are sniffing now.

Further improvements in the job markets are obviously essential to mitigate the risks of the above-mentioned dire scenario. As well as the containment of new Covid variant and an acceleration of vaccination in emerging countries.

- Macro volatility is a natural consequence of pandemic-like shocks

- Stagflation fears should evaporate, featuring just another episode of strategists’ versatility

- Still, developments of consumption must be monitored carefully…

- … as well as the pursuit of fiscal support