Date: 13 December, 2018 - Blog

Higher macro volatility spells lower visibility

OECD leading indicators weakened over last summer with almost total indifference. The flamboyant US growth concentrated attention and looked almost invincible in the wake of a very proactive Trump administration. But October proved a tipping point. Global ISM data, US housing, not to mention weak inflation metrics in Europe and Japan, finally broke the atmosphere.

Fear of a global disorderly rise of inflation has rapidly made way for recession concern. Just a few weeks ago, pundits were afraid of a 100$ oil price spilling-over into consumer goods. Now, the recent sharp setback of Brent / WTI is supposedly an advanced indicator of slower demand, hence poor growth…

Macro wishful thinking took a long time to end

But, furthermore, this brutal mood change does not prefigure – in itself – a severe deterioration of macro fundamentals

New buzzwords: Late (cycle) and (China) Deleveraging

The very mature nature of the US economic cycle has only very recently become a mainstream / consensus conviction. Logically, it raises lots of questions about the shape of its epilogue. God knows what finally submerged investors’ complacency: bad data on housing, the stubborn rise of interest rates, the sudden volatility and correction of equities? Ultimately it doesn’t matter. More interestingly, the sudden deterioration in sentiment will ultimately reinforce the process: cautious households or entrepreneurs may practically reduce their spending / demand, hence produce the slowdown…

China is gradually addressing its serious issue of addiction to debt. In the past couple of years, it has formally set the strategic objective of reducing debt pile. This goal is delicate to achieve internally, as it drains resources and support for lots of companies facing already a more competitive landscape (opening up to foreign competition, trade war and tariffs).

How actually late in the cycle US economy is, will be important for financial markets developments

The deleveraging process in China is delicate and may become problematic in case of a more severe trade confrontation

Crossing the river by feeling the stones

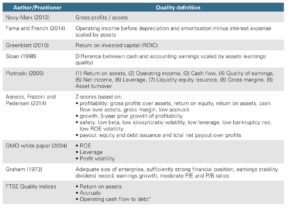

The most common metrics used to assess the quality of companies are: profitability, safety, and liquidity. It actually means several financial analysis criteria like gross and operating margins, ROA ROE ROIC; Debt to assets and interest coverage; net cash flow and liquid assets.

The outperformance of high quality stocks is well-documented in academic research over time in very specific periods i.e. more difficult times, be it economically, politically, or based on any other specific factor.

Definition of corporate quality

Source : Norges Bank working paper

Of course, one could use different qualitative or product / services related criteria to define quality, like the market share, the barriers to entry, the competitive / legal / political framework.

- Quality outperforms during market downturns and protects during bear markets

- Time has come to give a growing importance to corporate quality, when investing in equities and bonds

- The vast outperformance of high flying (growth) and leverage companies has (very) little chance to resume over next couple of quarters or so