Date: 31 March, 2020 - Blog

Conservatism – the Swiss way

The political landscape of the Swiss Confederation is deeply rooted on consensus. Its structure and functioning are fundamentally conservative. The composition of its government – the Federal Council – is guided by a quasi-irremovable ¨Magic Formula¨. Developments in Swiss politics are evolutionary, and decision-making is slow. The Neutrality of the country is a corollary feature of all of this. On the international stage, it provides Switzerland with a unique – enviable – position, and a much higher standing than its size / economic weight would deserve.

The financial sphere of Switzerland is highly oversized. This namely results from the above-mentioned features of its political landscape, from historic fiscal attractiveness and from the very mature stage of its economy. But it has also to do with part of the DNA of its population: reliability, punctuality, secrecy, respect of individual privacy.

Swiss banks (and insurers) belong to the World Top League. Swiss authorities famously saved UBS on two occasions, when it brushed with death (subprime and Birkenfeld fiscal crisis). The Swiss central bank has also proved to be second to none, when it comes to use its balance sheet as a weapon of CHF management / protection.

Everything that has to do with ¨Capital / Money¨ is key to Switzerland

When it comes to finance, Switzerland is pragmatic and proactive

Swiss authorities handle with dexterity high-level / innovative financial engineering

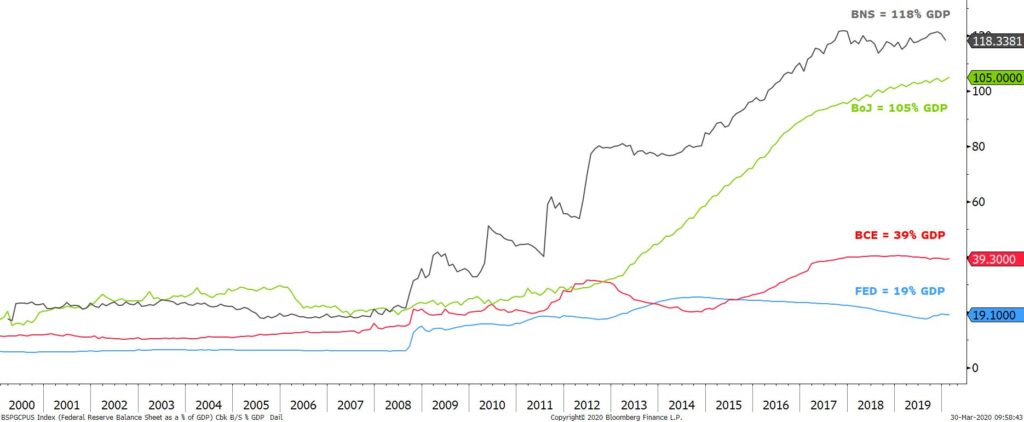

SNB balance sheet. A double edge sword

BS / GDP ratio

Source : Bloomberg

As long as the SNB strategy – of growing its balance sheet – delivered revenues (to the cantons) and results (taming CHF appreciation), few people cared. But let’s face it, this is a highly risky strategy. First, it may potentially qualify Switzerland as a currency manipulator according to the highly volatile criteria of the US administration. And second, it may prove tricky to manage in times of financial markets’ crisis, like the one we have entered now…

After years of success and tentative complacency…

… time has – finally – come for SNB to perform a benefit / risk analysis of its balance sheet strategy

Swiss-Finish QE: a nice Easter gift to needy Swiss citizens

Let’s figure out two original exit strategies from the top:

Option 1, rebalancing the portfolio. As we already alluded to in former publications, there is a clear mismatch between the portfolio structure and its ¨economic / currency¨ objective. In short, the very high proportion of USD and equity assets could be downsized at the benefit of Euro assets. Selling USD and buying Euros would respectively calm Trump and please Swiss exporters.

Option 2, downsizing its portfolio and launching ¨a Swiss QE for the people¨. It could for example finance swiss people health insurance in the heat of the sanitary crisis. Or subsidize a broadening / deepening of unemployment security. Both would be appropriate ¨social¨ measures, targeting primarily needy households.

- The upcoming publication of SNB Q1 financial results may be a tricky / tipping point

- SNB Board should consider re-orientating its global strategy on this occasion

- A dose of (Swiss-like) helicopter money could (politically) help adopt such a U-Turn