Date: 30 January, 2020 - Blog

Netflix has released higher than expected results and international new subscribers, but guidance remains cautious with the threat of new competitors. Disney+ and Apple TV+ were launched in November 2019. HBO Max (AT&T) will start in May 2020 and Peacock (Comcast) in July 2020. Other good news: negative free cash flow should decrease in 2020 to $2.5billion, after a peak at $3.3billion in 2019, coming from higher profits and not a content investment decrease.

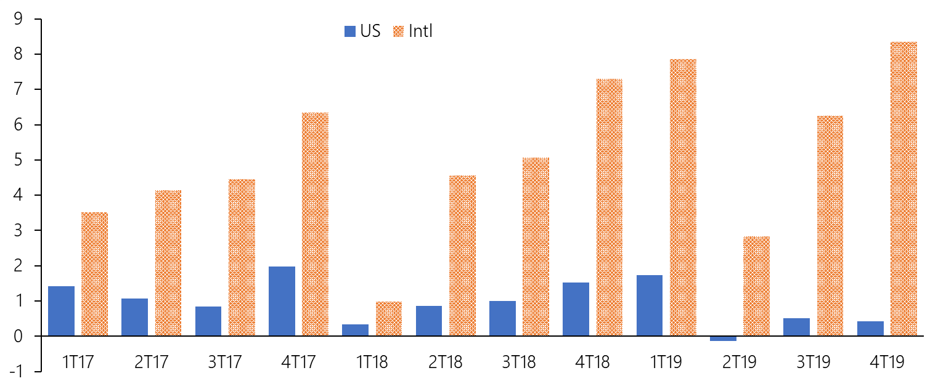

In 2019, the number of subscribers increased by 20% to 167.03 million (+18.4% in 2018 and +25.4% in 2017) thanks to the US for 36% and the international for 64% of revenues (31% EMEA, 19% LATAM, 10% APAC and 4% Canada). For now, the growth story remains valid thanks to the international market with total subscribers up by 37% in the Europe-Middle East-Africa region, 21% in LATAM and 53% in Asia Pacific.

New users (million)

Source: Netflix

2019 results were very good: revenues increased by 27.6% to $20.16bn and net profit by 54% to $1.87bn. The operating margin increased from 10.1% to 12.9%. Balance sheet cash amounts rose over $5bn.

The arrival of Disney+ and, to a lesser extent, of Apple TV+ affected the growth of new subscribers in the US: Netflix never experienced a so weak growth. The launch of Disney+ was a big success. However, the US market is mature, and this trend is logical.

To justify its huge spending budget in content production, the number of subscribers will have to rise at a sustained pace out of the US where Netflix enjoys limited competition, but Disney+ has decided to speed up its entry into the international markets; it will arrive in March on the Old Continent. Competition will become global, but not immediately.

Then there is a risk of a price war. Netflix could imagine other sources of revenue, such as digital advertising (denied by the CEO), but it would clash with other giants like Google, Facebook and Amazon, or video games.

- Investors are divided on Netflix. The real test will be the arrival of international competition, rather in 2021; Netflix currently keeps its competitive advantage