Date: 13 August, 2020 - Blog

Despite the rise in Covid infections around the world, the stock markets are not correcting thanks to:

- Monetary and fiscal infusions of central banks and governments.

- Better 2Q results than expected.

- Rapid advances in the discovery of vaccines and drugs to treat the effects of the virus.

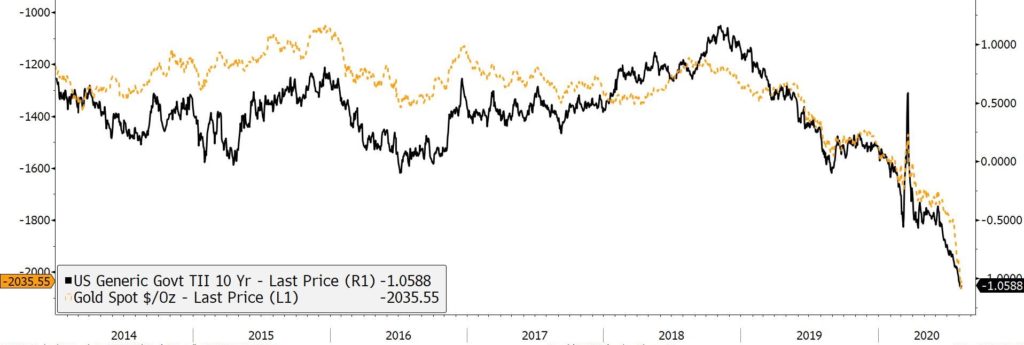

- The lack of alternatives in an environment of low interest rates. The US 10-year was at 2% at the start of the year compared to 0.55% today and the real 10-year US rate fell below -1% at the end of July.

There is no reason that indices correct abruptly despite the return to the highs of February 2020, with +50% for the MSCI World since the start of the rally on March 24th, neither from a technical point of view nor according to the Fear & Greed investor sentiment indicator.

With the rise in indices and the decline in profits, PE ratios are obviously surging. But the market anticipates a recovery in profits in 2021 and therefore a return of PE ratios to normal bases. For the S&P 500, the 12-month PER Forward should gradually decline to return to a valuation of 20x towards the end of 2020. See graph.

S&P 500. 12-month forward EPS and PE ratio

Source: Bloomberg

For the S&P 500, 90% of companies published their results, and 84% posted profits above estimates, the highest percentage since 2008. Profits are expected to decline 32% in 2Q instead of -43% estimated a month ago. For the Stoxx 600, profits will fall 67% in Q2 (the through of the decline), but the situation will gradually improve to see profits rebound by 50% in 2021.

The Value segment outperformed the Growth segment last week with the return of discussions on inflation and the prospect of an economic recovery thanks to massive injections of liquidity and the discovery of one or more vaccines.

Investors played it safe with FAANGs, growth and defensive stocks, and gold. The market valuation of the Russell Growth Index (including FAANG) is at historically high levels. The Fed’s largesse and the hope of a vaccine are behind this surge; but not only: for many investors, the health crisis will durably affect the social and professional life of each with social and professional distancing. The Work/Stay-at-home will become a standard. Then, the FAANG will benefit greatly. Real estate agents also report a change in household behavior: couples are looking for larger houses and apartments to be more comfortable, since they will spend more time at home (Stay-at-home), with an additional room to work (Work-at-home).

The Covid has accelerated the digital transformation. Investors are readjusting valuations towards a digital and much more automated world. We adhere to this medium to long term vision, justifying higher FAANGs’ and other technology companies PER ratios than the average of the indices.

Russell Value and Russell Growth. 12-month forward EPS and PE ratios

Source: Bloomberg

But in the near term, cyclical sectors could catch up in the event of good news on infection curves and vaccines, improving the economic outlook. A rise in nominal and real interest rates, as well as inflation, would be favorable to Value/cyclical sectors and unfavorable to sectors with high PE ratios. A rise in interest rates reduces the current valuation of FAANGs based on future cash flows.

With a cyclical bias, we favor Europe. Europe could also benefit from polls favorable to Joe Biden in the race for the White House; Joe Biden intends to raise the corporate tax rate to 28%. The election of Joe Biden would mean less international confrontation, especially with Europe. Green energy investment programs in Europe and the United States will be favorable to European companies where they dominate the wind sector.

Gold is technically very overbought. Its price perfectly follows real US interest rates. See graph below. If they were to rise, there is no doubt that the price of gold would fall.

Real US 10-year interest rates and gold price per ounce (reversed)