Date: 28 August, 2020 - Blog

The July 29th FOMC minutes indicate some concern over the state of the economy. This was due to the renewed pick-up in Covid-19 cases and many states scaling back their reopening. The pandemic effects were more than offsetting upward pressures on some prices. They were qualified of disinflationary. Amongst the FOMC, there was no appetite to deliver anything, despite agreement that inflation would likely continue to run well below their 2% inflation target for some time. All we got was the agreement that over coming months it would be appropriate to increase the balance sheet size at least at the pace of the last months.

The Fed would maintain the current Fed Funds range at least until one or more specified economic outcomes was achieved. According to the minutes, they could state at the next economic review that they would not raise rates before unemployment falls below 5% and inflation exceed 2%, for example.

The Fed dots of individual member forecasts suggest just 2 members expect rates to be raised before the beginning of 2023. It will merely reinforce the message that the Fed will really, really, really not raise rates imminently. This is anchoring the short end of the yield curve even more sturdily.

The limited enthusiasm for Yield Curve Control (YCC) expressed in the minutes has served to reinforce the recent curve steepening trend. YCC is where the Fed could use focused asset purchases to limit the long-end Treasury yields upside.

Most members judged that yield caps and targets would likely provide only modest benefits in the current environment. Officials are worried about potential costs of YCC including the possibility of an excessively rapid expansion of the balance sheet and difficulties in the design and communication of the conditions under which such a policy would be terminated.

Should yields start to rise more significantly? Perhaps as Treasury issuance is ramped up to finance a record deficit.

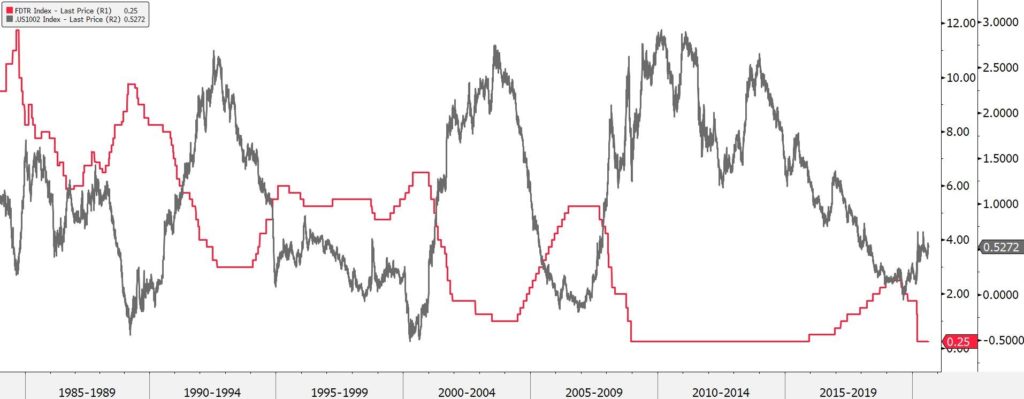

Fed Funds and yield curve

Source: Bloomberg

- US long-end yields are not so anchored

- Lack of Yield Curve Control enthusiasm keeps the curve steepening trend in play