Date: 25 June, 2020 - Blog

Equity markets are worried about the arrival of a second wave of coronavirus

Cases are increasing in Europe, the United States, China, New Zealand, India, etc. But the increase in cases is largely explained by a systematic process of testing to control the virus, manage the chain of transmission and adopt cluster strategies (management of delimited areas). This strategy seems to work if one observes Germany (700 contaminations in an industrial butchery) or in Beijing.

Epidemiology specialists are not worried about this normal process of controlling the virus. Conversely, during his last meeting in Tulsa, Oklahoma, Donald Trump railed against the increase in the number of tests, responsible for the increase in the number of cases in the United States; he asked his team to reduce testing: “Slow the testing down, please”. So smart!

Investors are worried about a weaker than expected economic reacovery. We have therefore seen a switch into more defensive sectors, such as FAANG, stay-at-home segment, technology / communication, staples, e-commerce and healthcare, sectors which rallied in April-May. For the moment, it’s more a healthy sector rotation than a drop in the stock market.

The indices are likely to fluctuate in a side band, the time to apprehend the strategy of the clusters. See MSCI World below. For the S&P 500, this corresponds to fluctuations between 2,990-3,230 points.

MSCI World. A pause was inevitable

Source: Bloomberg

The massive injections of liquidity from central banks and governments are powerful supporters of equities. The US Congress is currently discussing an extension of the Paycheck Protection Program for small businesses, additional support for the unemployed and a $1 trillion infrastructure spending plan directed to traditional infrastructure (roads, bridges, tunnels, airports, ports,…), 5G and broadband in rural areas.

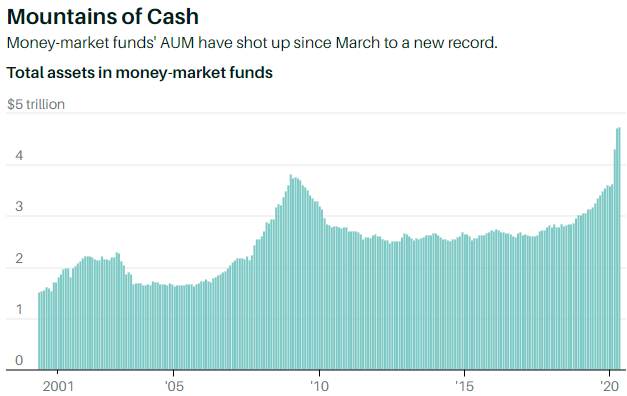

Another point of support (reduction in selling pressures on stocks) is the record of cash held by investors in money market funds in the United States, which, according to Morningstar, amounts to $ 4,800 billion, to the detriment of funds invested in stocks. In April and May, American investors withdrew $ 48 billion from US equity funds.

Total assets in money market funds

Source: Morningstar

At the same time, deposits in US commercial banks increased by 15% in March, April and May to $ 15.4 trillion, with American consumers cautious after receiving their checks from the government. As for companies, they accumulate cash after having raised debt, taking advantage of low interest rates, reducing dividends, share buybacks and capital expenditure (capex).

The importance of cash positions, reflecting the concerns of households and businesses, very low interest rates and monetary stimuli are favorable for gold. The breakout of $ 1,750 on the spot price would signal a rally towards $ 1,800, then the $ 2,000.

Now, it is difficult to understand the behavior of gold in the geopolitical tensions between India and China, knowing that these two countries account for 40% of the world demand for gold and that China is the 1st gold producer in the world; Will there be protection purchases from Indians and Chinese or a slowdown in purchases due to a malfunction in the supply chain? What is certain is that retail investors are buying massive amounts of gold and that central banks are still net buyers of gold.

Gold holdings in funds / ETFs invested in physical gold by retail investors

Source: Bloomberg

- The cluster strategy calls into question the economic recovery…

- … which favors a phase of consolidation of the stock markets

- Investors will alternate between airlines, automotive, value, cyclicals, small cap in calm seas and stay-at-home, health, FAANG sectors in rough seas

- A favorable period for gold